GSTR-3B is a special tax return form introduced by the GST Council for the purpose of accepting returns from taxpayers.

As per standard GST rules, a registered taxpayer is required to file GSTR-1 by the 10th, GSTR-2 by the 15th and GSTR-3 by the 20th of the next month for a relevant tax period. But to address the confusion and concerns different businesses have about GST, the Council has decided to relax the return filing timeline for the first six months. GST Council has given relief to taxpayers as they have to file only GSTR-3B Form July 2017 to June 2018 month tax.

Contents

What is GSTR 3B Form?

A new GSTR-3B form has been introduced by the government specifically for this purpose. For the first six months, the GSTR-3B is to be used to file tax returns. Taxpayers are still required to file GSTR-1, GSTR-2 and GSTR-3 forms. Once the GSTR-1 form is filed, the details will be auto-populated in GSTR-2 and GSTR-3 accordingly.

Video Tutorial: File GSTR 3B Return Form via Gen GST Software

The information provided in GSTR-3 will be matched against that of GSTR-3B form to cross-check for any difference in tax amount. The difference will be refunded and the pending amount needs to be paid.

Features of GSTR-3B Return

Significant features of GSTR 3B:

- Regular registered taxpayers need to file GSTR-3B on a compulsory basis

- Nil returns are to be filed, in case there does no business

- ITC availed and utilised required to be posted in the ledger

- A complete summary of purchase and sale information, tax payable and paid and including available input tax credit requires to be furnished

- ITC availed can be utilized in upcoming months

- The GSTR-3B form needs to be saved every time by clicking the save button

Who needs to File GSTR-3B?

GSTR-3B requires to be filed by every regular taxable person who is registered under GST. If you have two or more GSTINs, you will be required to file separate GSTR-3B for every GSTIN.

GSTR 3B is a consolidated form required to file by every regular taxpayer and if in case a taxpayer has 2 GSTIN then GSR 3B needs to be filed separately.

Registered businesses have to file NIL GSTR3B, in case there is no transactions occurred during the month (i.e., Nil GSTR 3B). There are taxpayers who don’t need to file GSTR 3B:

- Business registered under the GST composition scheme

- A non-resident taxable person

- Input Service Distributors

- TDS Deductor

- TCS Collector

- Database access or retrieval services (OIDAR) and online information suppliers who need to pay tax themselves

Simplified GSTR-3B Filing Process

Under the GST network, the GSTR 3B sales return form is now simplified as one can see the ITC balance on the return form itself. This time information comes in a single place for the GST return filing by taxpayers. On the top screen, one can find the current balance of ITC under GST. Tax head wise liability, balance amount are some of the amounts which need to be paid in cash.

Due Dates for Filing GSTR 3B

| Last Dates for filing GSTR 3B | |

| Month | Due Dates |

| Oct 2018 | |

| Nov 2018 | |

| Dec 2018 | |

| Jan 2019 | |

| Feb 2019 | |

| March 2019 | |

| April 2019 | |

| May 2019 | |

| June 2019 | |

| July 2019 | |

| August 2019 | |

| September 2019 | |

| October 2019 | |

| November 2019 | |

| December 2019 | |

| January 2020 | 20th February 2020* |

Note: GSTR-3B due date only for newly migrated taxpayers for months July 2017 to Feb 2019 has been extended till 31st March 2019.

Note: From October 2017, the late fee payable by a taxpayer whose tax liability for that month was ‘NIL’ will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts).

GSTR-3B is to be filed latest by 20th of the next month for a tax period.

How to file details in GSTR-3B?

GSTR-3B will be the first tax return form to be filed under GST. The form consists of 6 tables which will include the details of outward and inward supplies, ITC details, and tax payment details.

Table 1 or 2: The taxpayer needs to enter his/her GSTIN number and legal name (or business name) in the respective columns.

Table 3: This will contain the details of taxable supplies liable to reverse the charge. It is further divided into the following two heads.

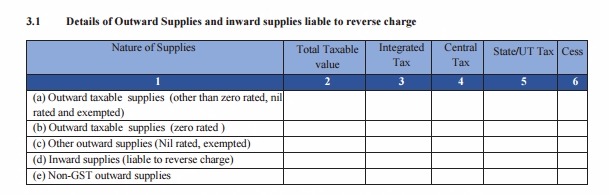

Table 3.1 Details of outward supplies and inward supplies liable to reverse the charge.

This will include the total tax details of both the intrastate and interstate supplies of the following nature:

- Outward Supplies of goods/services which are not exempted, zero-rated or nil rated.

- Outward Supplies of commodities which are zero-rated.

- Outward Supplies of Nil rated and exempted goods/services

- Inward supplies on which reverse charge is liable.

- Outward supplied of non-GST goods/services

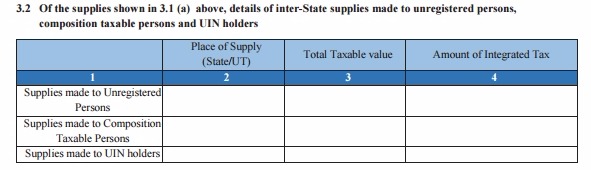

Table 3.2 Of the supplies shown in 3.1 (a) above, details of Interstate supplies made to unregistered persons, composition dealer and UIN holders.

This table will contain the details (Place of Supply, Taxable value and IGST) of outward supplies made to an unregistered dealer, UIN holder or to a composition registered person.

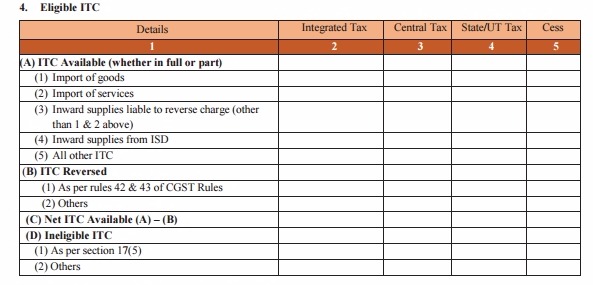

Table 4 Eligible ITC

This will have the complete details of ITC available, ITC reversed, net ITC amount, and ineligible ITC. It has following parts.

ITC Available (whether in full or part): Details of all inward supplies including the imports of goods, import of services, reverse charge inward supplies, and inward supplies from Input Service Distributor (ISD), on which ITC is applicable.

ITC Reversed: Details of ITC reversed or to be reversed

Net ITC available based on information provided in (A) and (B)

It will contain the details of GST paid on ITC ineligible inward supplies.

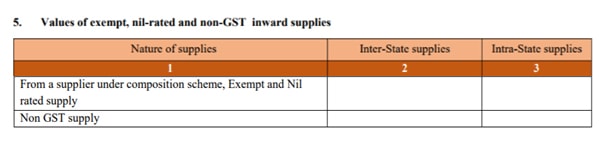

Table 5 Values of exempt, nil-rated and non-GST inward supplies.

This will include the details of inward supplies made from a composition registered supplier, exempt and nil rated inward supplies, and details of Non-GST inward supplies.

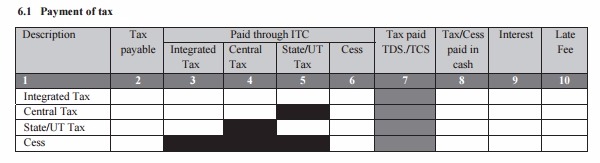

Table 6 Payment of Tax

Table 6.1 based on the inward and outward supply details and ITC details mentioned in the tables above, you need to self-ascertain tax payable amount and enter the details in this table. The details of tax paid through ITC, in cash, and other details will be filled accordingly.

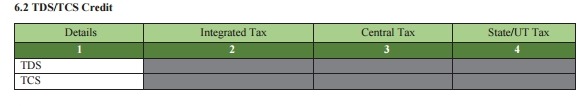

Table 6.2 However, TDS and TCS are not applicable as per GST provisions, the taxpayers are still required to enter the information of TDS (Tax withheld by the Government establishment) and TCS (Tax withheld by E-commerce operator) in this table.

Download GSTR 3B Format in PDF

Nice information provide.

Excellent information