After furnishing the details of Inward and Outward supplies using GSTR-1 and GSTR-2 respectively, a registered taxpayer needs to pay his/her GST tax through GSTR-3 monthly return Form by 20th of the next month.

GSTR-3 Form is used to file the monthly tax returns on GST portal. Below is mentioned the table-wise procedure to fill required information in GSTR-3.

| GSTR 3 Due Dates | |

| For Month Of | Due Dates |

| July 2017 to March 2018 | Postponed until 31st March 2018* |

Note: In normal cases, regular due dates for GSTR-3 is 20th of the next month for a particular tax period.

Note: For subsequent months, i.e. October 2017 onwards, the amount of late fee payable by a taxpayer whose tax liability for that month was ‘NIL’will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts).

Click here for current due dates of all GSTR forms.

You can download GSTR 3 form from here.

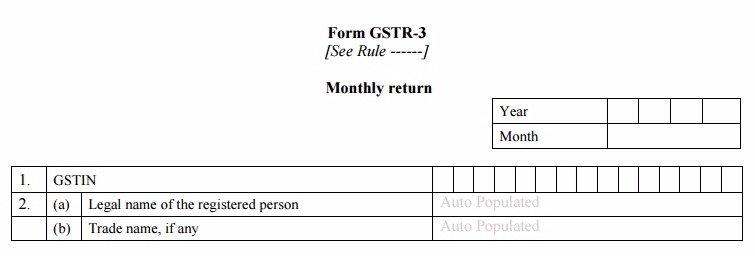

Table 1 & 2: This will contain the details of the taxpayer, including their GSTIN number, name of the person, and his/her trade name.

Contents [Hide]

Part-A of GSTR-3

Part-A information will be auto-populated based on the information provided in GSTR-1, GSTR-2 and GSTR 1A.

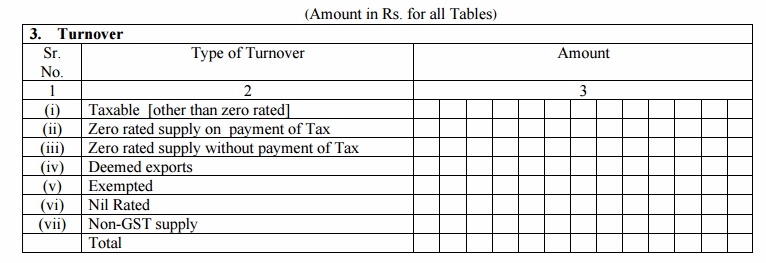

Table 3 will contain the overall turnover information of the taxpayer for all inward and outward supplies.

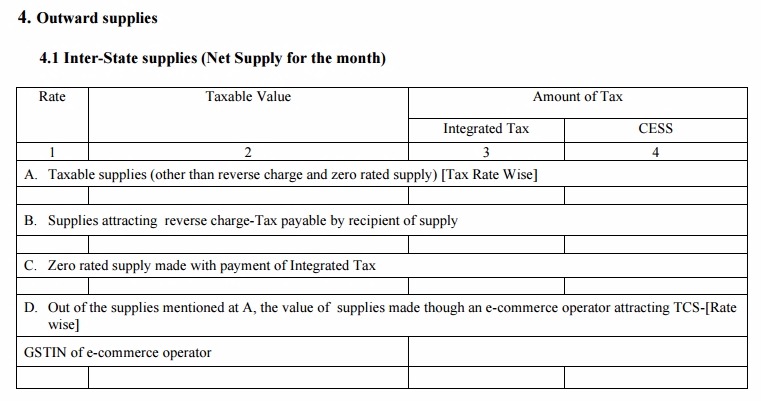

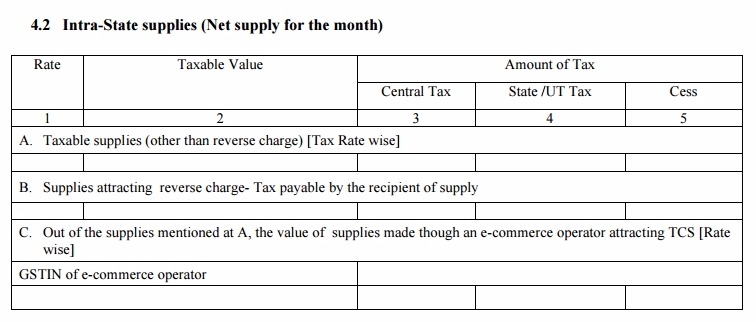

Table 4 will include the tax liability information for outward supplies, net of debit/credit notes, invoices and advances received (Information from GSTR-1).

Table 4.1 will include details of Inter-state outward supplies, other than zero rated supplies made without payment of tax.

Table 4.2 will include the similar details as Table 4.1, only for Intra-state outward supplies.

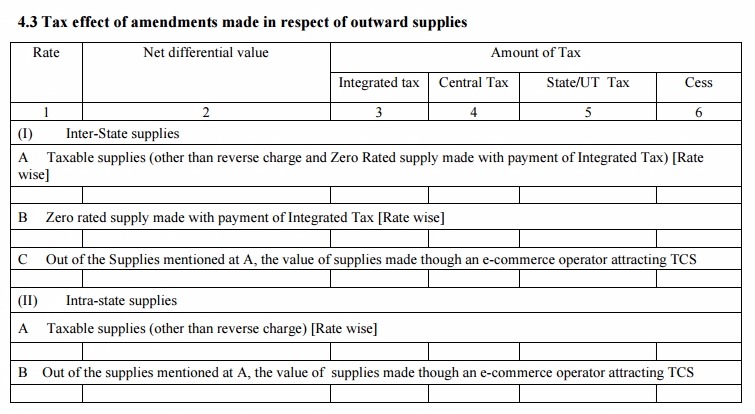

Table 4.3 will consist of details of amendments made towards outward supplies and their effects on tax, except the amendments of supplies originally made under reverse charge basis.

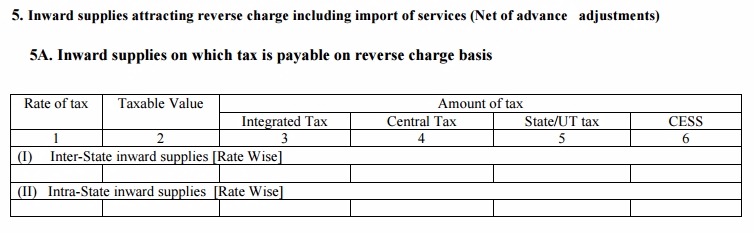

Table 5 will include the tax liability information for the reverse charge on inward supplies, net of debit/credit notes, invoices and advances received and adjustment made out of earlier tax paid on advances (Information from GSTR-2).

Table 5A will consist of inward supplies (rate-wise) for which tax is payable on reverse charge basis.

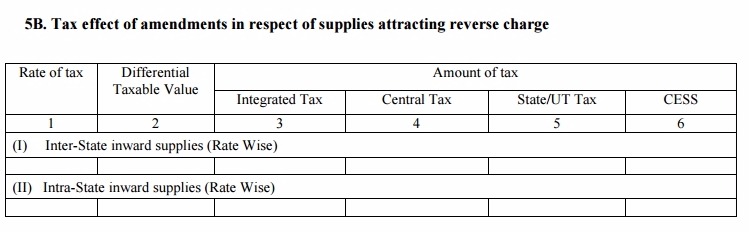

Table 5B is to include amendments made for supplies attracting reverse charge and their effects on tax.

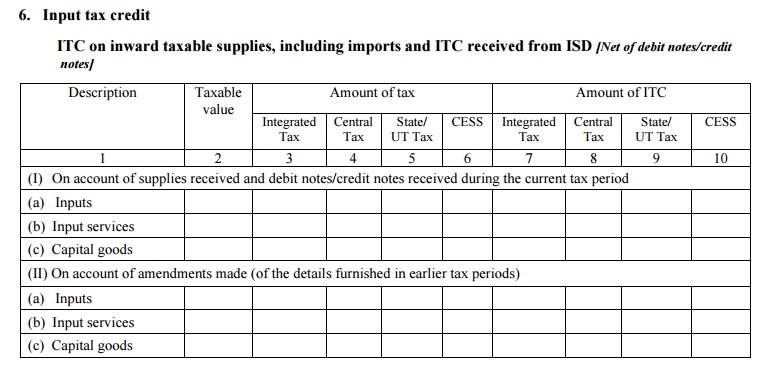

Table 6: This will include the information of Input tax credit (ITC) on inward supplies and imports and ITC received from ISD, net of debit/credit notes.

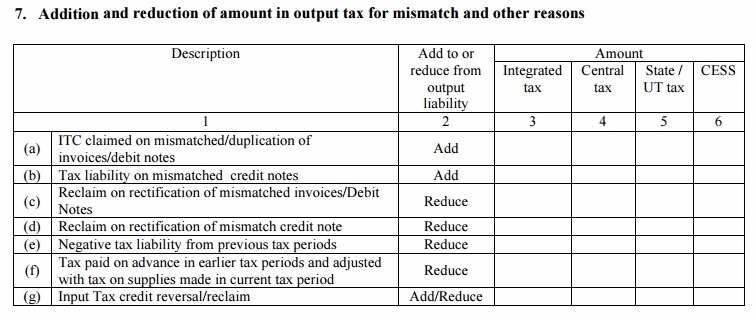

Table 7 will contain the details of addition and reduction in output tax amount for mismatch and any other reason, if any.

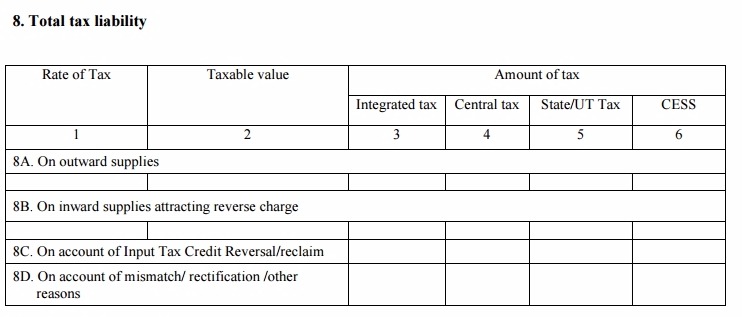

Table 8 will show the total tax liability for the particular month. This information will auto-populate based on the outward and inward supplies declared in the above tables. The table will show separate IGST, CGST and SGST values for different commodities.

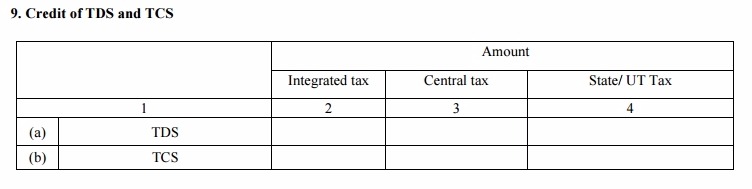

Table 9 will include the information of TDS (tax deducted at source) and TCS (tax collected by e-commerce operators) credits, which will auto-populate from GSTR-2 Form of the taxpayer.

Table 9 will include the information of TDS (tax deducted at source) and TCS (tax collected by e-commerce operators) credits, which will auto-populate from GSTR-2 Form of the taxpayer.

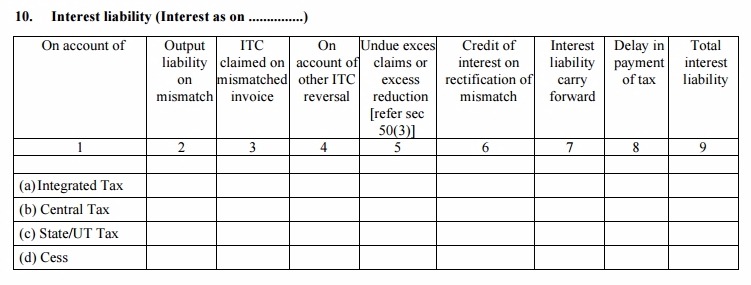

Table 10 will contain total interest liability information.

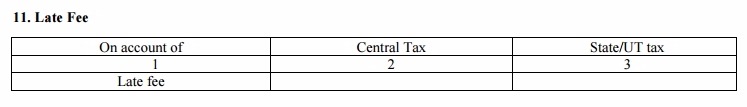

Table 11 will have details of late fees, if any.

PART-B of GSTR-3

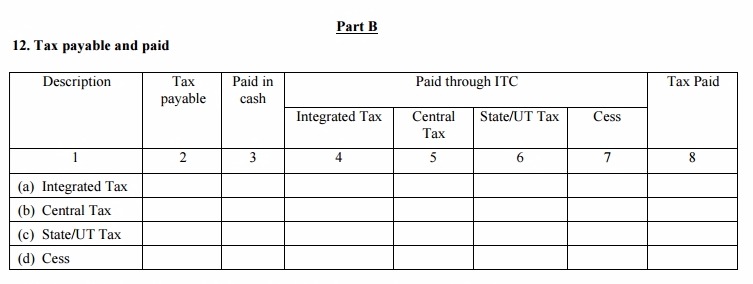

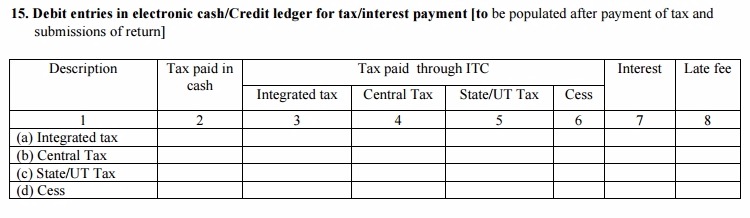

Part-B of the form will be used to pay taxes, interest and late fee (if any) by using available credits from electronic credit ledger and cash ledger.

Table 12: Based on the information provided in the heads above, this table will determine the payable and paid tax amounts. It will show separate tax information for IGST, CGST, and SGST. Also, the information of total tax payable, tax paid in cash and paid by ITC credit.

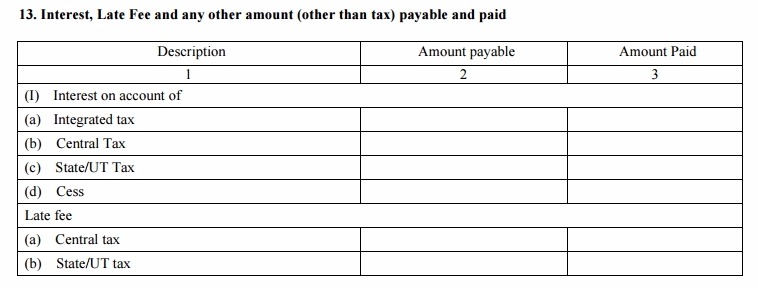

Table 13: The details of interest, late fee and any other amount (except actual tax) payable and paid.

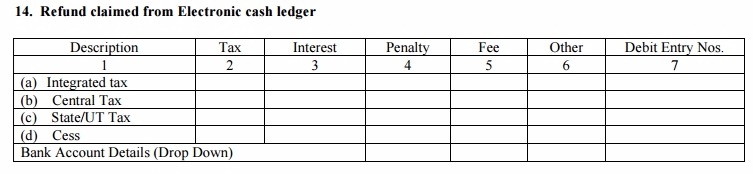

Table 14: This will contain the information of refund claimed from electronic cash ledger.

Cash ledger refund can only be claimed when all the return related liabilities have been discharged for that particular tax period.

Table 15: Refund claimed through table 14 will result in an automatic debit entry in the cash ledger on the filing of GSTR-3 form.

Notes:

GSTR-3 is generated only after the successful filing of GSTR-1 and GSTR-2

After the payment of tax through GSTR-3, the information in Electronic cash ledger, credit ledger and liability register of the taxpayer will be automatically updated.

GSTR-3 filed without discharging complete liability will not be considered a valid return.

It taxpayer has filed a return earlier which was not valid and later on, he wishes to discharge the remaining liability, then he is required to file the Part-B of GSTR-3 again.

Terms Used

- GSTIN: Goods and Services Tax Identification Number

- TDS: Tax Deducted at source

- TCS: Tax Collected at source

After the completion of details in all these tables, the taxpayer will have to sign digitally at the bottom of the GSTR-2 Form.

Feel free to ask your GSTR-3 related queries in our free GST Helpline India.

2 Replies to “How to File GSTR-3 for Monthly Tax Returns (Updated)”