Contents

What is GSTR 7A (TDS Certificate)?

GSTR 7A is a form under goods and services tax for the TDS deductors i.e. tax deducted at source from the supplier’s payments. The GSTR 7A is auto-populated when the taxpayer files the GSTR 7 form on the official government portal. The form has all the relevant details of tax deducted at source on the products supplied by the dealer. Whenever the deductor pays the tax deducted at source amount, it is then shown in the credit ledger of the deductee.

Who is liable to Obtain the GSTR 7A TDS Certificate Form?

All the dealers who deduct the taxes on the source need to obtain the GSTR 7A TDS certificate

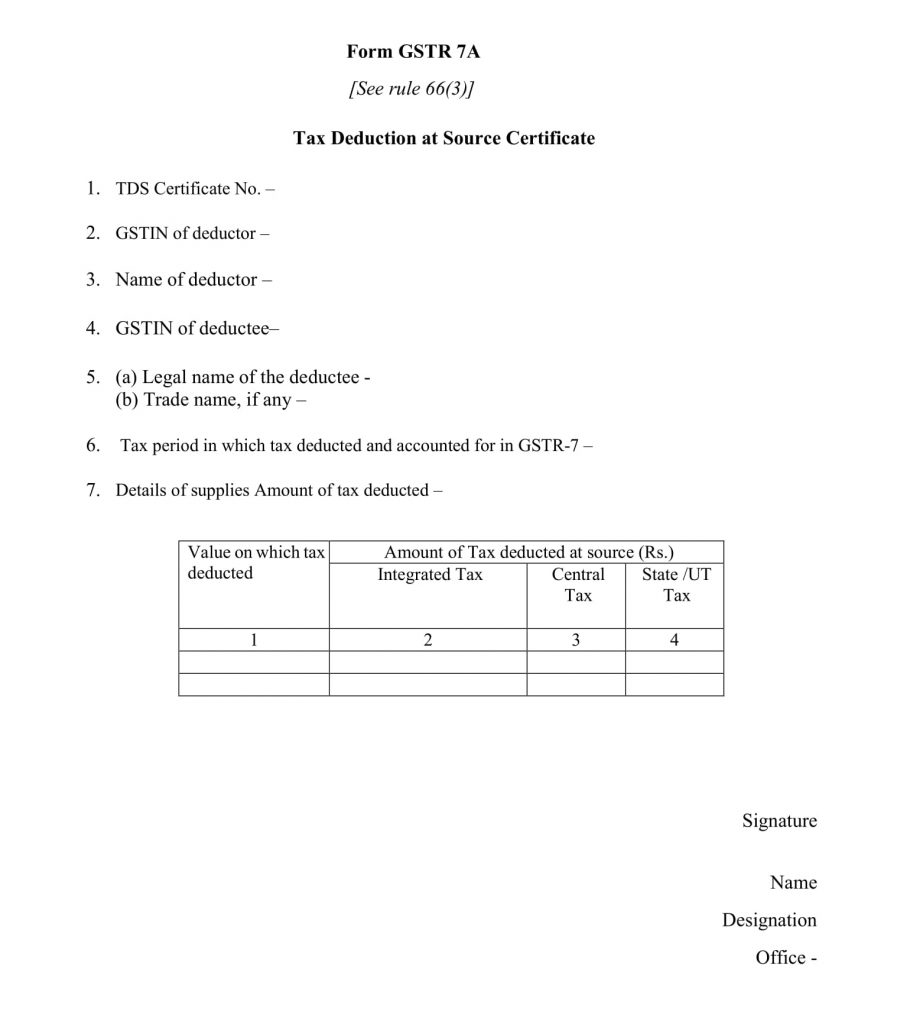

What is the information in Form GSTR 7A?

- TDS Certificate No.

- GSTIN of TDS Deductor

- Name of the Taxable person / Contractor:

- GSTIN of Contractor (Supplier)

- Assessment Circle / Ward

- Tax Period for which GSTR 7 is filed

- GSTIN of Deductee

- Contract Details

- Invoice Details Date of TDS_IGST

- Payment Value on which TDS deducted

Read Also: Infosys Design New GST Return Forms For Traders: Roll Out in 6 Months

Format of Form GSTR 7A

The details about GSTR 7A (TDS Certificate) is explained above. If you would like to add more information about Form GSTR 7A, comment below:

Download GSTR-7A Form in PDF here