GSTR 10 is a kind of no due certificate which a taxable person has to file as their final GST return when they apply for cancellation of their GST registration. The return is required to be filed within 3 months of the cancellation application.

GSTR 10 is not to be confused with GSTR 9, which is an annual return required to be filed by every registered taxpayer every year. GSTR-10 Form, on the other hand, is the final (one-time) return statement.

Contents

GSTR 10 Due Date – When to file it

For the due date, It is mandatory for a registered taxpayer to file the one-time GSTR 10 form within 3 months from the date when their GST registration was cancelled or the date of issuance of the cancellation order, whichever is later.

GSTR 10 Eligibility – Who should file it

GSTR-10 is a final statement document that is required to be filed by a registered taxable person whose GST registration has been cancelled or voluntarily surrendered, for any reason.

GSTR-10 Prerequisites

The following conditions must be met in order to be eligible to file GSTR-10:

- The return filer must be an existing or former GST registered taxpayer holding a 15-digit GSTIN.

- The aggregate annual turnover of the taxpayer’s business should be Rs 20 lac or more.

GSTR-10 Penalty for not or late filing

In case if a registered taxpayer fails to file their GSTR 10 within the due time (3 months), a notice will be sent to them by the Authorities instructing to file the return providing all the required documents and clear their pending taxes within 15 days time. If the person still doesn’t file their final return, the final order for registration cancellation will be issued by the tax official mentioning the payable tax amount along with interest and penalty.

How to File GSTR 10 Form?

Now that you are clear about the prerequisites for GSTR 10 filing, let’s find out details to be provided in the form.

Download GSTR-10 Form in PDF Format

GSTR 10 has the following 10 heads.

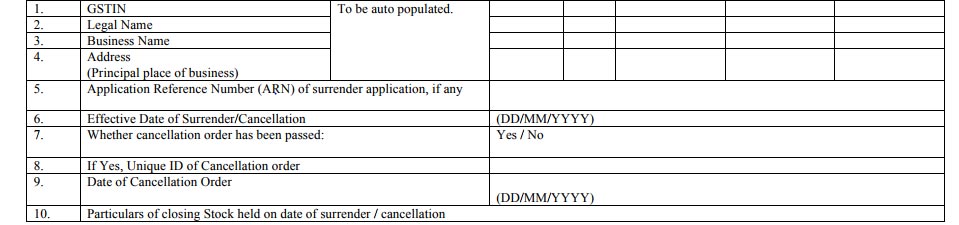

The details in the first 4 field will auto-populate based on your login details while the remaining fields will have to be completed manually by you.

1. GSTIN – The 15-digit GSTIN number of the registered entity will appear in this field.

2. Legal Name – of the taxpayer will appear here

3. Business Name – Name of the registered business

4. Address (Principal Place of Business): Registered address of the business/person

5. Application Reference Number (ARN) of surrender application, if any

If your registration cancellation request has already been accepted by the authorities, you need to furnish the Application Reference Number (ARN) sent to you along with the cancellation order in this field.

6. Effective Date of Surrender/Cancellation

Enter the date of cancellation of registration as mentioned in the order sent to you.

7. Whether cancellation order has been passed

Mark ‘Yes’ if the cancellation is being done after you received an order from the authorities. Mark ‘No’ if it is a voluntary cancellation.

8. If Yes, Unique ID of Cancellation Order

If the cancellation is based on an order passed by the authorities, please mention the unique ID of the order in this field.

9. Date of Cancellation Order

Mention the date on which the cancellation order was issued by the authorities. (It is not necessarily the date on which you received the order or the date on which your registration was cancelled.)

10. Particulars of closing Stock held on date of surrender/cancellation

The taxpayer needs to mention here the details of closing stock on hold at the time (date) of cancelling the registration. The credit amount regarding such stock is required to be paid while filing this return.

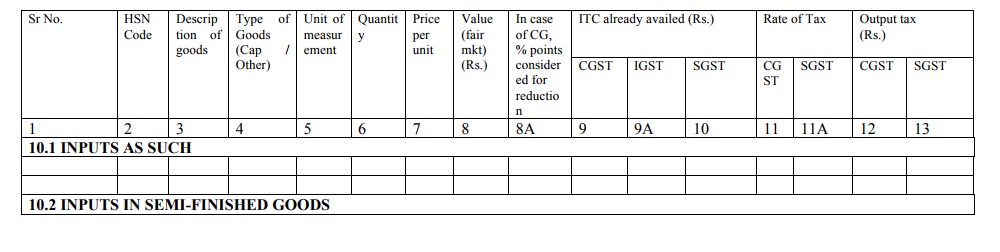

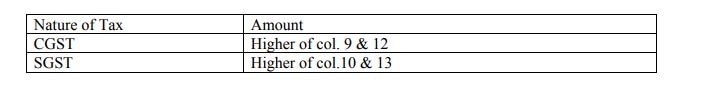

10A. Amount of Tax Payable on Closing Stock

On the basis of the stock information provided by you in the previous head, the amount of credit (CGST and SGST) lying in capital goods and/or input goods will be automatically calculated and updated under this head. This amount is needed to be paid by you to the government.

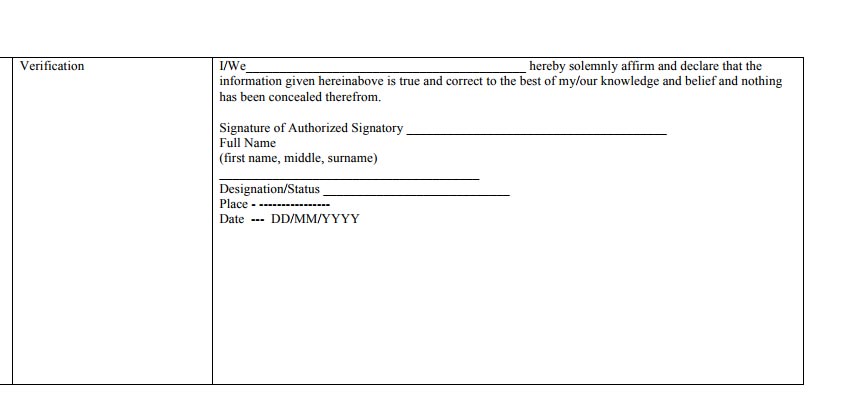

Verification

After furnishing all the details in this form, the taxpayer has to sign digitally at the end of the page verifying the authenticity of the information provided.