In the pre-GST era, e Way Bill was a physical document required to be produced to allow the movement of goods. Similarly, the CBEC (Central Board of Excise & Customs) has introduced an e-way bill in GST to facilitate the movement of supplies with the value over 50,000 INR.

E-way bill was announced with the launch of GST system on July 1 in India, however, the official launching of the e-way bill is still on hold owing to the technical issues on the online registration portal. Stay close to this page to know more about E-way bill updates.

Press Release for GST e Way Bill Implementation

Contents

What is e-Way Bill?

E-way bill meaning is that it is an electronic document that is required to allow the movement of goods with a value of more than Rs. 50,000 anywhere in India. The e-way bill can be generated on the GST portal online or through SMS by a registered person. Along with the bill, a unique e-way bill number (EBN) is generated and allocated to the supplier, transporter, and the recipient.

Objectives of E- Way Bill Listed Below

- E- Way Bill helps to reduce illicit activities such as tax evasion. Under E- Way Bill, an individual is entitled to provide the details of goods invoice under GST so the individual is not able to provide the misleading information in goods invoice

- Through robust technology such as Radio Frequency Identification Devices (RFID), the buyer and seller can track the goods under E- Way Bill.

When is an e-Way bill Generated?

An e-way bill is required to be generated by a registered person when there is a movement of goods of value over fifty thousand rupees,

- In relation to a supply

- For reasons other than supply (like a return)

- Inward supplies made from an unregistered person

The e-way bill will be generated before the commencement of movement and must contain the details of the goods being transported.

The ‘supply’ refers to the supplies made for a consideration (payment process) which may or may not be in the course of business, or a supply without consideration (supplies without payment). In other words, the sales, transfer and exchange/barter of goods will be treated as a supply, and such movements will require e-way bill to be generated through GST portal.

Recommended: Types of Supply under GST

E-way bill will be generated by the registered person who is either the supplier or the transporter carrying the movement of goods of value more than Rs. 50,000. A registered supplier or transporter may even choose to generate and carry e way bill for non-compliant supplies, i.e. goods of less than Rs. 50,000.

For the supplies being made by an unregistered person to a registered person, the unregistered supplier or the transporter may also decide to generate e way bill, but only the registered person (i.e. the recipient) will be required to do the compliances.

Who Generates the e-Way Bill?

An e-way bill is generated before the movement of goods by a registered supplier.

- The registered person who is transporting goods as the consignor to the recipient (who is consignee), using a personal or hired service

- The registered person (whether consignor or consignee) who hands over goods to transporter

- Transporter of goods if the bill if not created by the supplier

The unregistered supplier where the recipient is registered under GST – Recipient will be liable to do the compliances as if he is the supplier.

Recommended: E-Way Bill Software: Top Features You Should Know About

E-Way Bill Format

A particular form is to be filled by the concerned party in one of the above-mentioned conditions. Following is the e-Way billing format:

- Part A of FORM GST INS-01 is to be filled online on the GST Portal by the registered supplier.

- Part B of FORM GST INS-01 is to be filled by the registered person or the recipient of goods.

- Part A and B of FORM GST INS-01 are to be filled by the registered person who hands over goods to the transporter.

- FORM GST INS-01 will be filled by the transporter of goods if it is not done by the consignor.

- E-way bill will be generated through FORM GST INS-01 by the supplier or the transporter for the supplies where the supplier is unregistered. If the recipient is a registered person in such case, he/she shall be treated as the supplier.

- Separate e-way bills will be generated in case if multiple consignments are scheduled to be transported in one conveyance. The transporter will mention the serial number of each e-way bill in the FORM GST INS-02 and will generate a consolidated bill on the Portal.

- The e-way bills can be verified at any time during the transit by the Commissioner or his empowered authority, a report of which will be recorded by the proper officer in Part A of FORM GST INS – 03 within 24 hours of the inspection.

- The final report of the inspection is to be recorded in Part B of FORM GST INS – 03 within 3 days of the inspection.

- FORM GST INS- 04 will be used to upload the information in case if a vehicle has been detained for more than 30 minutes for non-compliance of e-way bill rules.A registered person can also upload a tax invoice using the Form GST INV-1 on the portal.

e-Way Bill Validity

An e-way bill comes with an expiration date which depends on the distance. Validity will begin from the time and date of generation of the bill.

- 1 day validity for the distance of less than 100 KM.

- 3 days validity for 100KM to 300KM distance

- 5 days validity for 300KM to 500KM

- 10 days validity for 500KM to 1000KM

- 15 days validity for 1000KM and more

The GST Commissioner has the right to extend the validity of the e-way bill for certain goods.

Rules Regarding e-Way Bill

The GST E-way Bill Rules are as follows:

- Any supply (transportation) of value more than Rs. 50,000 is liable to have a valid e-waybill.

- The bill can be generated by a registered as well as an unregistered person.

- A transporter or supplier may even generate an e-way bill for the supplies with the value less than 50,000.

- The unique e-way bill number is required to be made available to the supplier, the recipient and the transporter.

- A separate e-way bill will be generated by the transporter for each distinct use of transporting vehicle during the transit.

- If multiple consignments are transported in one conveyance, the transporter must generate and carry the consolidated e-way bill with him.

- Form GSTR-1 for the supplier will be auto-populated based on the information provided in Part A of Form GST INS-01.

- If the goods are not being transported or the supply is cancelled after the generation of e-way bill, the bill can be cancelled on the GST portal within 24 hours of generation.

- The details of e-way bill will be shared with the registered recipient who will have to communicate or confirm the receipt of the supply covered under that particular bill.

- E-way bills can also be generated and cancelled through SMS.

The transporter will have to carry a copy of the e-way bill or the bill number along with the invoice/ bill of supply or delivery challan. - A registered tax person can upload his tax invoice using FORM GST INV-1 on the GST portal to obtain an Invoice Reference Number which will be valid for 30 days from the uploading date.

- The information in Part A of Form GST INS-01 will be auto-populated based on the information provided in FORM GST INV-1.

- For supplies which do not require to carry an e-way bill, the transporter will still have to carry the right tax invoice or bill of supply or bill of entry or a delivery challan.

An exemption in case of E Way Bill under GST

The Movement of Goods does not require E-Way Bill are listed below:-

|

Sr. No. |

Description of Goods |

|

1 |

Liquefied petroleum gas for supply to household and non-domestic exempted category (NDEC) customers |

|

2 |

Kerosene oil sold under PDS |

|

3 |

Postal baggage transported by Department of Posts |

|

4 |

Natural or cultured pearls and precious or semi-precious stones; precious metals and metals clad with precious metal (Chapter 71) |

|

5 |

Jewellery, goldsmiths’ and silversmiths’ wares and other articles (Chapter 71) |

|

6 |

Currency |

|

7 |

Used personal and household effects |

|

8 |

Coral, unworked (0508) and worked coral (9601)”; |

|

9 |

Goods being transported are alcoholic for human consumption, petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas or aviation turbine fuel; |

|

10 |

Supply of goods being transported is treated as no supply under Schedule III of the Act. |

Area Wise Exemption

- Whenever the goods are transported from the airport, air cargo complex, customs port as well as land customs station to an inland container depot or a container freight station for clearance by Custom

- In case of transporting goods in specific areas have mentioned under clause (d) of sub-rule (14) of rule 138 of the Union territory or under Goods and Services Tax Compliances in that particular State or Union territory

- In respect of goods are transporting under customs bond from a container freight station or an inland container depot to air cargo complex, a customs port, airport and land customs station, or from one customs port/ customs station to another/customs port/customs station.

- Whenever the goods are transported either under customs direction or under customs seal

- Goods transported are shipping from least developed countries such as Nepal or Bhutan

- Whenever vacant containers are transported from one country to another country

- Goods being transited up to a distance of 20 KM from the place of the business of the consignor to a weighbridge for weighment or from the weighbridge return to the place of the business of the given consignor subject to the condition that the transit of goods is attached by a delivery challan issued in accordance with rule 55.

Recommended: GST eWay Bill Not Required within 50KM For Job Work in Rajasthan

Vehicle Wise Exemption

- Whenever the goods are moved through non-motorised conveyance such as cycle rickshaw, skateboard, push scooters and more

- In case of any Central Government, State Government or local authorities are transport goods via train/ rail as a consignor

Person Wise Exemption

- Whenever goods are transported from/ to the Ministry of Defence as a consignor/ consignee

- Whenever the Central Government/ State Government/ Local Authorities have transported goods through rail/ train as a consignor

Concept Of Consolidated E Way Bill

Whenever the consignor is transporting goods from the same origin of different HSN codes of various taxpayers, the transporter is required to carry with himself multiple E Way bills at the time of transporting goods. If the transportation documents have been verified by GST Officer than the transporter is required to generate various E- Way Bill for the verification purpose.

To solve the issue of multiple e waybills, the Consolidated e-way bill was introduced by the Indian government. It is a document that consists of various E-Way bills for multiple consignments which is necessary to bring at the time of transporting goods.

Consolidated E Way Bill consists information of all sender/ consignor and 1 QR Code.

Transported who is shipping various consignors and consignees in one truck/vehicle can carry consolidated E Way Bill rather than the multiple e-way bills.

Though, the transporter is entitled to generate a consolidated e-way bill while carrying various consignments in one truck or vehicle.

How to Generate an e-Way Bill in GST

The e-way bill can be generated online on the GST portal gst.gov.in or through SMS by a registered number.

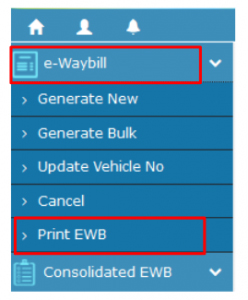

In addition to e-way bill (EWB) generation, the portal also has options for changing vehicle number on an already generated EWB, printing EWB, cancelling an EWB and more. In this article, we will discuss the procedure for generating e-way bill on the portal.

Things you will need to generate an e-way bill:

- An account on the EWB Portal

- Transport ID or Vehicle number – for by road transports

- Transport ID, Transport Document Number, and Date mentioned in the document – for transports by rail, air or ship

- The Bill/Invoice/Challan for the particular consignment for which EWB is being generated.

Step-by-step Guide for Generating an E-way Bill Online

Step 1: Register on the e-way bill portal (https://ewaybill.nic.in/).

Login to your EWB portal account by entering the Username and password used at the time of registration.

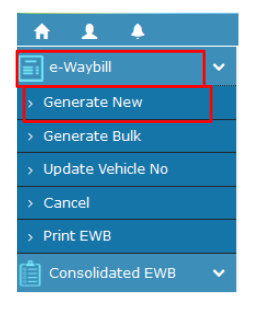

Step 2: In the left sidebar, click on e-Waybill > Generate New option.

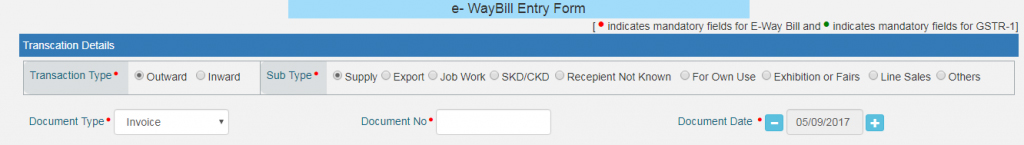

Step 3: The next screen displays the e-Waybill Entry Form. Enter the following details here.

1) Transaction Type

Depending on whether you are a recipient or supplier of consignment, select Inward or Outward respectively.

![]()

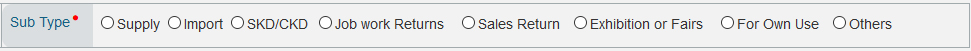

2) Sub-type

Select the transaction sub-type (actual type) from the available options.

3) Document type

The type of document (Invoice, Bill, Challan, Bill of entry, Credit note or anything else) that you have for that consignment.

4) Document No.

The document/invoice number

5) Document Date

The date mentioned in the document. You cannot enter a future date here.

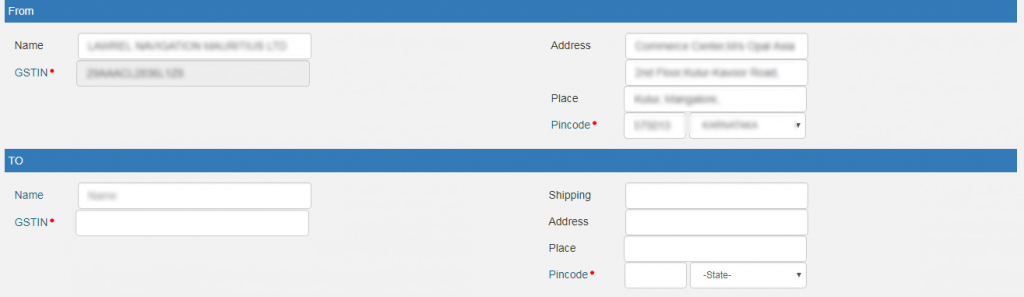

6) From/ To

Enter the addresses of the sender and the recipient respectively.

If either Supplier or Recipient is unregistered, mention ‘URP’ in the respective GSTIN field.

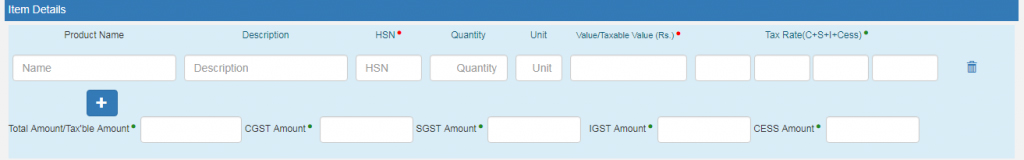

7) Item Details

Add the following details about the consignment:

1. Product name

2. Description

3. HSN

4. Quantity

5. Unit

6. Value/Taxable value (Rs.)

7. Tax rates of CGST and SGST or IGST (in percentage), and Cess, if charged

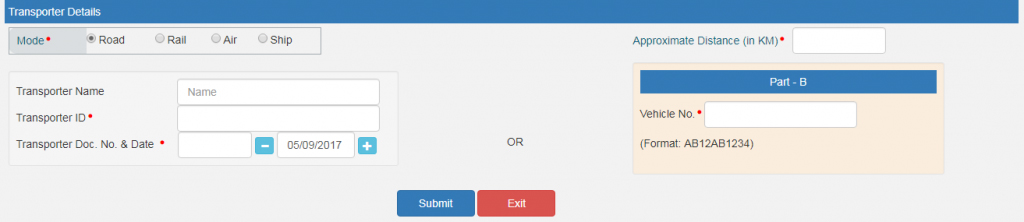

8) Transporter details

The transporter information, including the mode of transport (road/air/ship/rail), transporter name, ID, transporter document number & date, and vehicle number will be mentioned here. The fields marked with a * are mandatory.

Step 4: After entering and checking all the details, click on ‘Submit’ button. The system automatically validates the data and shows if an error is found. If not, the request is processed successfully and the e-way bill is generated.

Note that every e-way bill has a unique 12 digit number for identification.

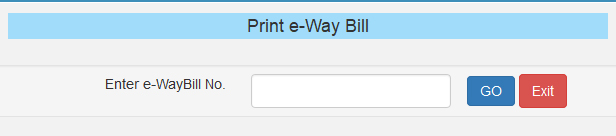

Step 5: Print E-way bill

Click on “Print e-Way bill” option given at the top of the generated e-Way bill if you want to get it right now.

To print an old bill, visit e-Waybill > Print EWB option from the sidebar. Now, enter the e-way bill number for which you need to take the print and click on ‘Go’ button. Click on Print option at the top of the page.

Make sure to print and carry a valid e-way bill for transportation of goods with the value over Rs. 50,000.

when i have create 2 bill with value of 25 Thousand one bill so total amount of 2 bills 50Thousand

so please tell me how to create e way bill in this condition

E waybill can be generated over the value of Rs. 50000.

if the total limit of goods on a vehicle is ₹50,000 but the goods belong to three different people, how will the e-way bill be generated in that case.and who will generate this way bill transporter or consignor

GST is applicable to value over Rs. 50,000.

dear sir,

i want training about E waybill how to fill up information and how to genrating E waybill.

This blog post is updated with the complete procedure of generating e-way bills. Please check again

plese specify e way bill helpline number.

There is no particular helpline number for the e-way bill. If you have any issue related to GST or e way bill, GST help desk is available.

E WAY BILL RULES FOR EXPORT