CMP-08 is a GST return filing which was introduced in April 2019 to be effective from FY 2019-2020 onwards and applicable for composition dealers. It replaces the ongoing GSTR-4 quarterly form which is filed by composition dealers on a quarterly basis. In this article, you can read the complete information about the new Form GST CMP 08, the due date for filing, penalty for non-filing, and the filing procedure.

Let’s get started.

What is Form CMP-08 and Who Needs to File it?

CMP-08 is a statement/challan Form which must be filed quarterly by composition dealers as a way to declare their self-assessed tax liability for that quarter. The same form will be used for the payment of tax.

Form GST CMP-08 must be filed by all composition dealers who have registered under the GST composition scheme using CMP-02. Composition dealers are required to pay their taxes every quarter, and so they must file this statement and pay the taxes by using the challan form.

Besides Form CMP-08, composition dealers are also required to file the GSTR-4 Form return via the revised format on an annual basis.

Due Date for Filing Form GST CMP 08

Form CMP-08 is a quarterly return form which must be filed on or before the 18th of the following month for a specific quarter.

For April-June 2019 quarter, the last date for filing Form CMP-08 is now 31st August 2019.

For non-filing of Form GST CMP 08 by the due date, the taxpayers will have to pay a penalty of Rs 200 per day (Rs 100 CGST + Rs 100 SGST) until the day return is filed, subject to a maximum late fee of Rs 5,000.

How to File Form CMP 08 (Statement for payment of self-assessed tax)

The Form GST CMP-08 has four sections, which will be filed as follows:

Section 1: GSTIN

In the first section, the taxpayer needs to input his/her GSTIN along with the Financial Year & Quarter for which they are filing the statement.

Section 2: The section contains details of the business, including the legal name of the owner, Trade name (business name), ARN (Application reference number), and the date of filing. The details in this section are auto-updated based on the filer’s GSTIN.

Section 3: Summary of self-assessed liability

In this table, the taxpayer will have to provide a summary of the various supplies, including outward supplies (both exempt & non-exempt), inward supplies attracting reverse charge (+ imports), net of debit/credit notes and advances for the given quarter. Then, they need to calculate their tax liability and interest (if any) and furnish the same in respective fields.

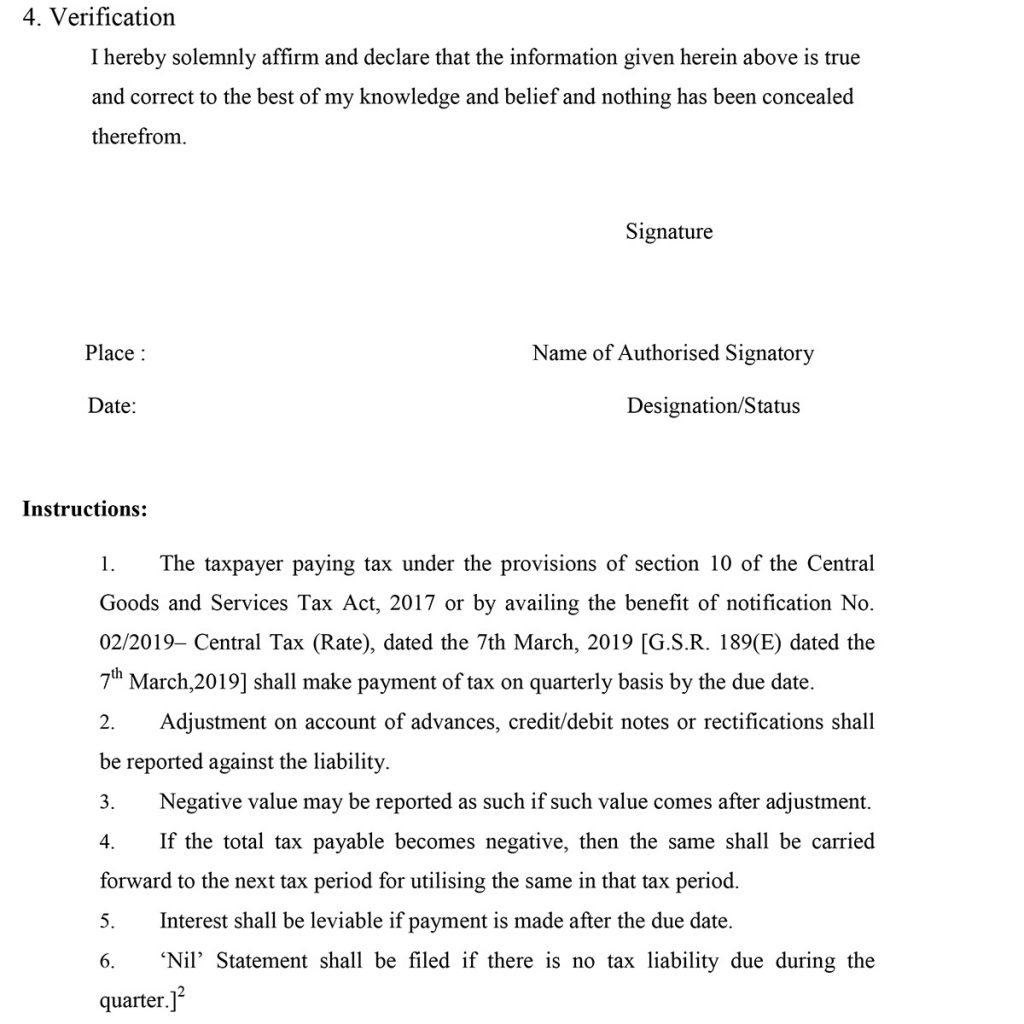

Section 4: Once the above sections are completed, the taxpayer needs to provide his/her affirmation by signing the form.

Make sure to read the instructions carefully before you start filing the form. A taxpayer must still file the ‘Nil’ return even if their tax liability is zero for that quarter.