Taxpayers can now update their registered email and mobile number in the GST system. The decision comes in response to the complaints from the taxpayers.

The same was confirmed by the Finance Ministry in a press release. The press release says:

”the intermediaries who were authorized by them to apply for registration on their behalf had used their own email and mobile number during the process”.

Here’s how to Change in Email ID and Mobile Number on GST Portal:

Taxpayers must reach out to their respective Jurisdictional tax authority and follow the below procedure to make the necessary updates :

- Identity Proof: Taxpayers must provide valid documents to the tax office as identity proof as well as confirm the business details as per his/her GSTIN.

- Tax Officer Verification: The tax officer in revert will cross verify if the concerned taxpayers is a Stakeholder or Authorized Signatory for that GSTIN in the system.

- Authentication: Upon verification, the tax officer will upload necessary proof on the GST Portal.

- Following authentication, the tax officer will reset the email id and the mobile number provided by the respective taxpayer as well as upload the documents on the GST Portal.

- Post document upload, the Tax officer will reset the password. This is a temporary password for the GSTIN.

- The Username and Temporary password will be sent to the taxpayer’s respective email address.

- Next Taxpayer must log in to GST Portal https://www.gst.gov.in/ using their Username and the temporary password shared in the mail.

- On first time login, the taxpayer would be prompted to change his/her username and password. The taxpayer can now update/ change his username and password as per his wish. The said username and password can now be used by the taxpayer.

Note: To check Jurisdiction, please visit https://www.gst.gov.in. Your respective jurisdiction is displayed in red text.

Just follow these simple steps to change your mobile number and email id on GST portal-

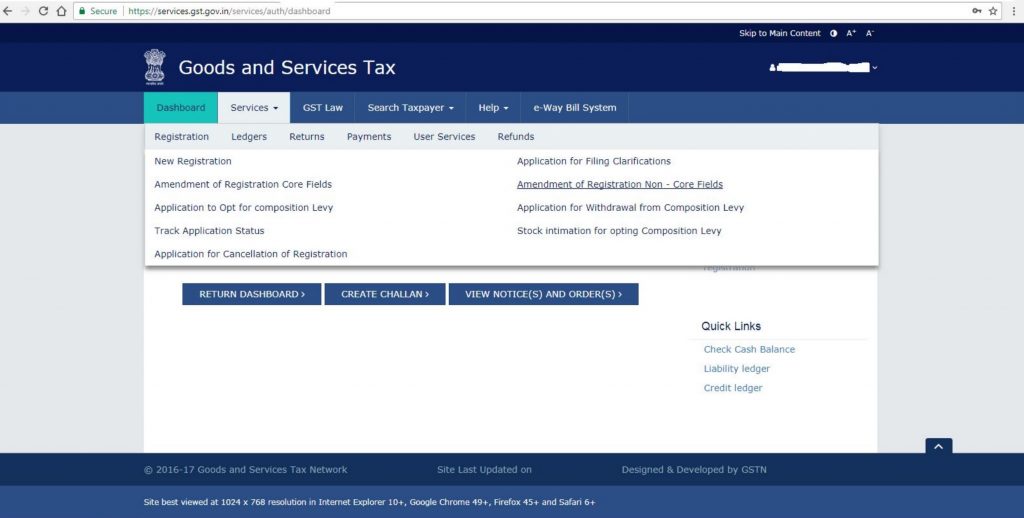

1. First, open GST Portal and log-in your account

2. After log-in your account go to these options:

SERVICES -> REGISTRATION -> AMENDMENT OF REGISTRATION NON-CORE FIELDS

NOTE: If you can not access and edit the details then go to SERVICES -> MY SAVED APPLICATION and click on the edit option.

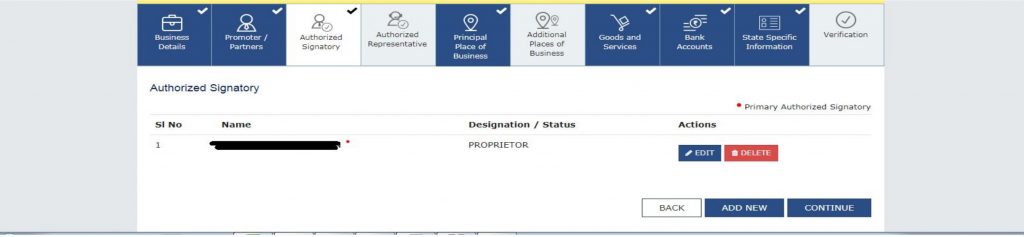

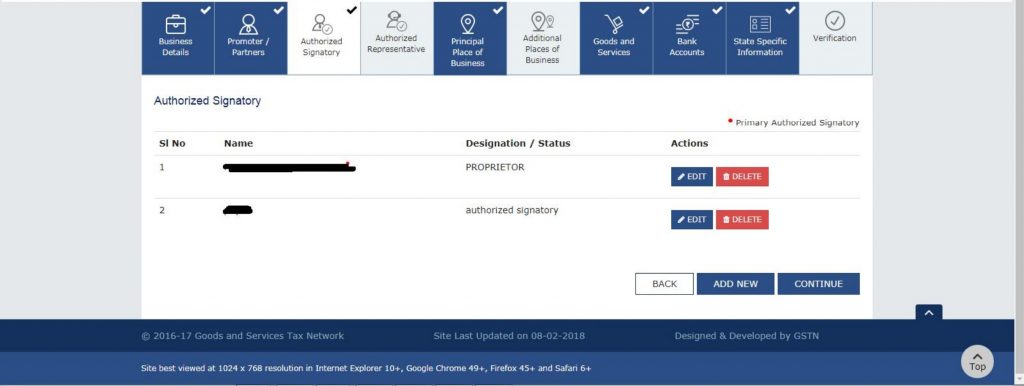

3. Now go on Authorized Signatory tab and press on ADD NEW

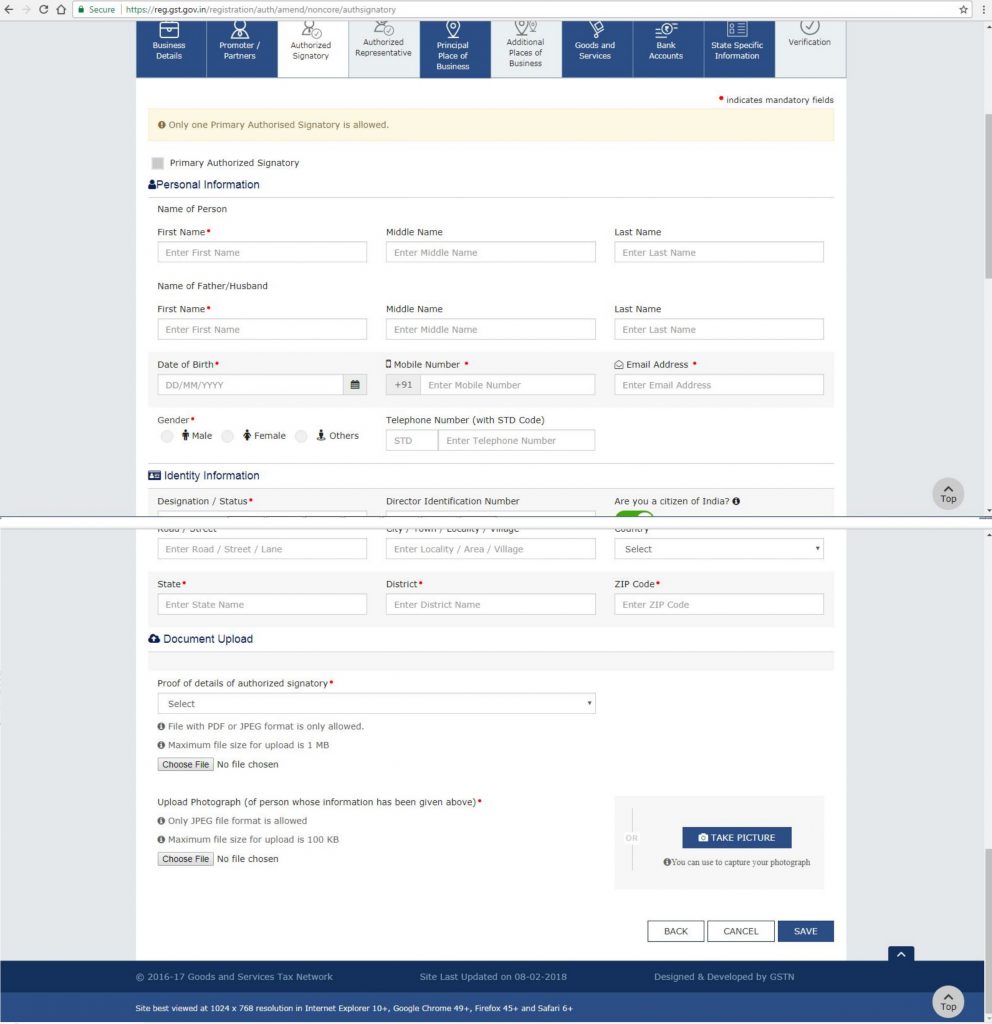

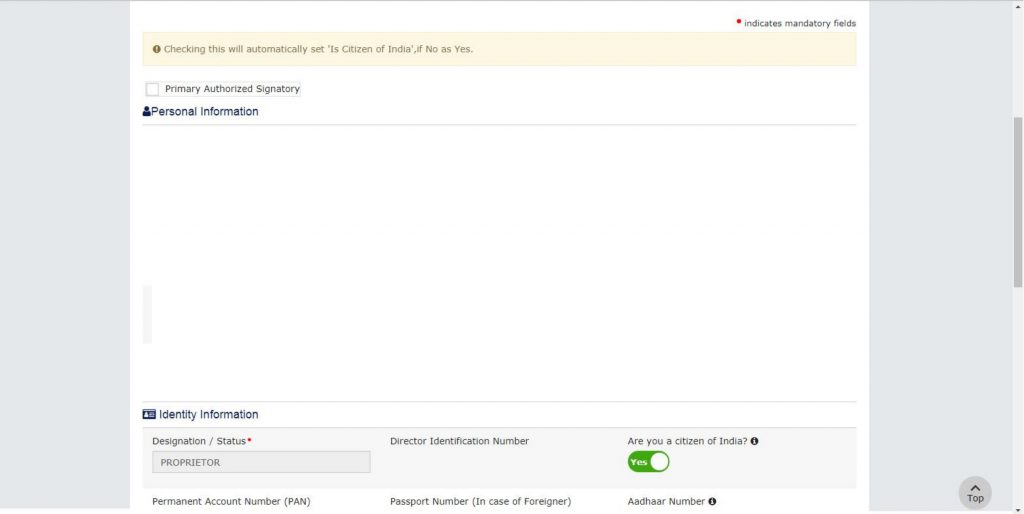

4. Add a dummy person data and upload the required documentation as well as you filed for the proprietor. Enter the Mobile Number and Email ID which you want to change on GST portal and press SAVE button.

5. After press saving button the dummy person also show in the list

6. Now click on Edit option for original authorized proprietor and uncheck the primary authorized signatory box.

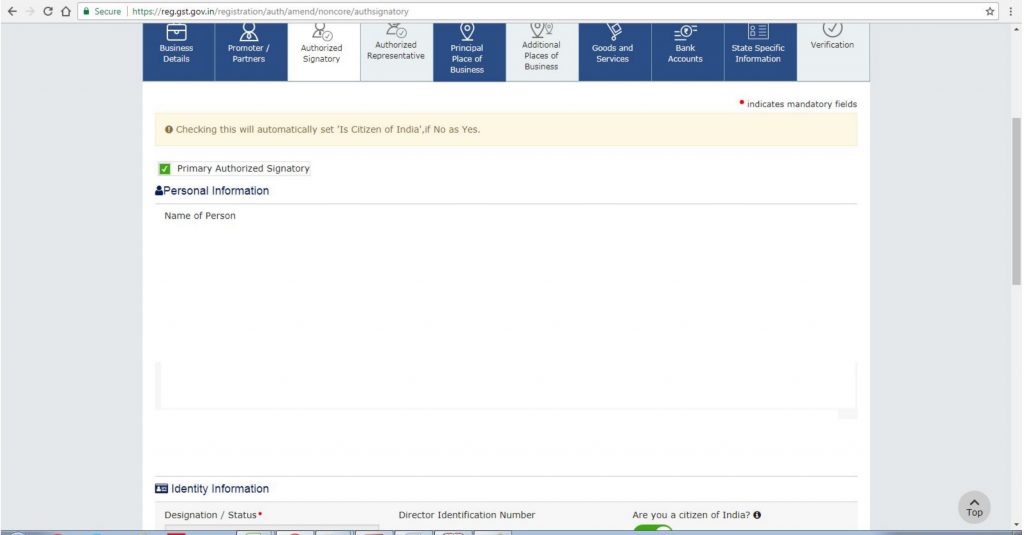

7. Now go to the primary authorized signatory box of dummy person and click on the checkbox.

8. After clicking on checkbox you see green right mark. Now you can see the Mobile Number and Email ID tab.

Here you can update your mobile number or email id.

9. Press on Save button after updating your mobile number or mail id.

10. Now a Pop-up window appears. Enter the OTP which you received on updating mobile number and email id.

11. After verifying your OTP your new mobile number and email id is updated on GST Portal.

12. Now make primary authorized signatory to your original authorized proprietor. And don’t forget to delete the dummy person.

After completing your process click on SAVE and CONTINUE and submit your application.