GSTR 11 is a GST return form that is to be filed by UIN holders who wish to claim a refund of the tax paid by them on their inward supplies.

Let’s find out more about GSTR-11 in this article.

Contents

What is UIN?

UIN is the Unique Identification Number issued under GST to specific people and agencies working on behalf of the United Nations and some multilateral financial institutions and persons in India. Since foreign embassies and missions are not required to pay taxes under GST, the UIN helps them claim a refund of the taxes paid by them on their purchases.

The Unique Identification Number can be acquired by eligible agencies by registering themselves on the GST portal through Form REG-13.

The following agencies are eligible to apply for a UIN:

- Special agencies affiliated with the United Nations Organization

- Foreign embassies and consulates

- Multilateral financial institutions and organizations notified accordingly under the UN Act, 1947

- Other persons or category of persons as notified by the Commissioner.

What is GSTR 11?

GSTR-11 is the monthly GST return that is required to be filed by UIN holders in India who wish to claim a refund of the tax paid by them on their local purchases. It is the “Statement of inward supplies by persons having Unique Identification Number (UIN)”.

It is mandatory to have a valid UIN in order to be eligible to file GSTR-11 and claim the tax refund.

GSTR 11 Form Filing Due Date

GSTR-11 is a monthly return that must be filed latest by the 28th of the month following the tax period in which the said purchase is made by the UIN holder.

GSTR 11 due date for instance, if the GST was paid on the purchases made in March 2019, GSTR 11 to claim a refund of the taxes must be filed by 28th April 2019.

How to File GSTR-11 Form?

GSTR 11 is a simple GSTR return with only 4 heads.

Follow the steps below to file the GST return.

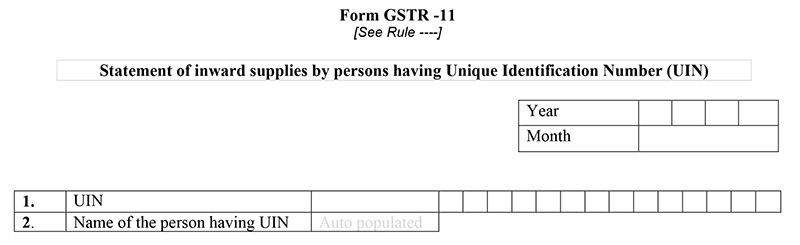

1. UIN

The unique identification number (UIN) will auto-populate in this field based on the user login/profile details.

2. Name of the person having UIN

The name of the person holding the unique identification number will auto-populate in this field.

Year & Month

Enter the Year and Month for which you wish to claim a GST refund.

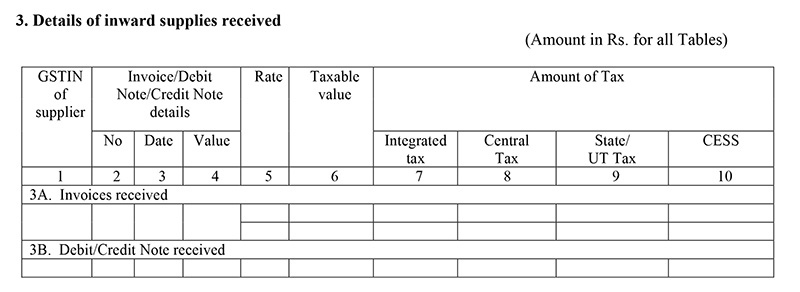

3. Details of inward supplies received

This head will contain the details of the inward supplies (purchases) received by you during the month. These details will auto-populate based on the GSTIN of the suppliers entered by you. The details in this head cannot be modified by UIN holders.

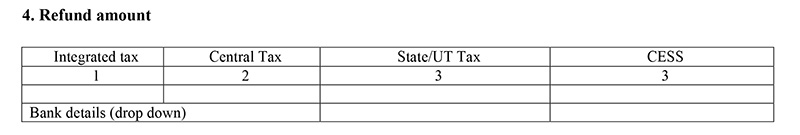

4. Refund Amount

Based on the details of inward supplies, the refund amount will be automatically updated in this head. You need to manually enter the bank details where you want to receive a refund of the tax paid on these supplies.

After furnishing all the details in the above heads, you will have to provide a digital signature at the end of the page confirming the authenticity of the information provided in the return.

Note: GSTR 11 is not required to be filed by regular citizens of India.