The Goods & Services Tax (GST) is the newly launched tax system in India that was implemented on July 1. The new tax regime has completely replaced the existing indirect tax system of the country introducing many new terms and processes.

The old tax returns are now replaced with GST Returns. GSTR Forms are the special return forms used by registered taxpayers to file their tax returns on the common portal under GST. GSTR 1 of one of the GST returns forms.

Contents

What is GSTR 1?

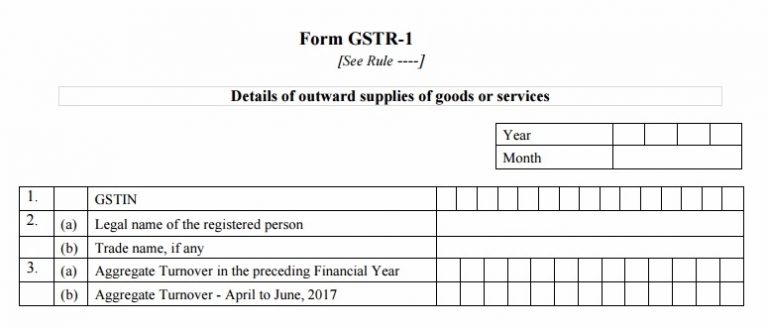

GSTR 1 is the first of the GST Return Forms that a registered taxpayer needs to file on monthly basis. GSTR 1 Form will be used to file the details of the outward supplies (sales) made by a registered dealer during the particular tax period (month). The form has total 13 sections/tables. GSTR 1 is mandatory to file for every month even if there was no business activity (nil returns) for the given tax period.

GSTR 1 with Example

GSTR 1 is the very first of the GST return forms, and it is mandatory to file it in order to file the next returns including GSTR 2 and GSTR 3. Let’s understand the concept and process of GSTR1 Form with an example.

Suppose that you are a GST registered dealer who supplies furniture to small dealers. Now, if you are filing the GSTR 1 Form form for July month, the details of all the supplies made by you in this month will go into the form.

Your tax liability will be determined on the basis of the supply values and other things like input credits, etc. Also, the details you provide in your GSTR 1 Form for a particular recipient will also be available in the GSTR 2A form of that receiver.

Revised Due Dates for GSTR-1 Turnover up to Rs 1.5 Crore

| GSTR-1 Due Dates (Up to Rs 1.5 Crore) | |

| Months (Quarterly) | Due Dates |

| Jan – March, 2019 | |

| April – June, 2019 | |

| July – Sept, 2019 | |

| Oct – Dec, 2019 | 31st January 2020* |

Note: For all the newly migrated taxpayers GSTR 1 due date ((Turnover Up to Rs 1.5 Crore) for all the quarters from July 2017 to December 2018 extended till 31st March 2019.

Revised Due Dates for GSTR-1 more than Rs 1.5 Crore

The regime has revised the due date of filing GSTR 1 return (turnover more than Rs. 1.5 crores) to the 11th day of the next month.

| GSTR-1 Due Dates (More than Rs 1.5 Crore) | |

| Monthly | Due Dates |

| Jan, 2019 | |

| Feb, 2019 | |

| March, 2019 | |

| April, 2019 | |

| May, 2019 | |

| June, 2019 | |

| July, 2019 | |

| August, 2019 | |

| September, 2019 | |

| October, 2019 | |

| November, 2019 | |

| December, 2019 | |

| January, 2020 | 11th February 2020* |

Note: GSTR 1 due date (Turnover above Rs 1.5 Crore) for all the newly migrated taxpayers is extended till 31st March 2019 for months from July 2017 to December 2018.

Note: From October 2017, the late fee payable by a taxpayer whose tax liability for that month was ‘NIL’ will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts).

Download GSTR 1 Format in PDF & Excel?

The GSTR 1 Form has to be filed in a specific format as specified by the GST Council on its portal. The GSTR 1 official format is mentioned below. All taxpayers need to file their returns only in the specified format on GST portal online.

There is also the provision of filing GSTR 1 offline where you can file the form, upload invoices in offline mode first and then upload it to the portal using this GST Returns Offline Tool. There are also some GST software applications in the market that allow you to file GSTR 1 and other returns from your desktop and/or mobile from a single dashboard.

In case if you want to check and download the GSTR 1 Form in excel format, you can do it here. We have attached GSTR 1 in excel format here so you can use it offline. You can use the offline form to practice and file GSTR 1 Form using the offline return filing tool.

GSTR 1 Form Excel Format Download

You can also download the GSTR 1 pdf format here but it is not allowed to file the pdf offline. However, you can use the official GST Returns offline tool if you want to file your tax returns in offline mode.

GSTR 1 Form pdf Format Download

Why is GSTR 1 important?

GSTR 1 is an important return form as the information provided by a supplier will be used to calculate his/her tax liability in GSTR 3 for the particular period. The details furnished by the supplier in the GSTR-1 Form will also auto-populate in GSTR 2A for the recipient of such supplies.

Checklist for GSTR 1 Filing

There are a few things you will require to do or collect before going ahead with filing the GSTR-1 Form on the portal.

Here’s the list of things that need to be provided when filing this return:

- Aggregate turnover – For the previous financial year (April 2016-17) and previous quarter (April 2017 – June 2017)

- GSTIN and invoice details, including the invoice number, date, value, tax rate and place of supply, for supplies made to a registered dealer.

- Invoice details, including the invoice number, date, value, tax rate and place of supply, for supplies under RCM (Reverse Charge Mechanism)

- Invoice details, including the invoice number, date, value, tax rate and place of supply, for inter-state supplies made to unregistered dealers and having invoice value of more than 2.5 lakhs

- Invoice details, including the invoice number, date, value, tax rate and place of supply, Bill of entry or shipping bill number and date, for zero-rated and deemed supplies

- Consolidated invoice details, including the tax value, rate, tax amount and place of supply, for supplies made to unregistered dealers (not covered in rule 4)

- GSTIN and Invoice details, including the invoice number, date, value, tax rate and place of supply, for supplies to E-commerce (online marketplaces)

- Separate details/summary of Nil rated, exempt and non-GST supplies made in inter-state/intra-state to a registered or unregistered person

- If a debit or credit note or refund voucher is issued to the registered dealer, the details of the document including document number, date, value, tax rate, amount and place of supply, and original invoice number and date or original dr/cr note or refund voucher number and date

- Document number, date, value, tax rate, amount, place of supply, and original invoice number and date, for debit or credit note or refund voucher, issued to unregistered dealers

- Gross value, net value, tax rate and place of supply for advances received and/or adjusted

- HSN Code, UQC (Unique Quantity Code), Total Qty, Total value, Total Taxable value and Tax details

- Documents issued during the particular tax period, including outward supply invoice, inward supply invoice (from an unregistered person), debit/credit note, revised invoice, receipt voucher, refund voucher, payment voucher, delivery challan for job work, the case of liquid gas, supply on approval and other cases.

Some of the items in the list may be optional based on the taxpayer, supply and other factors.

How to file GSTR 1 Full Procedure and Guidelines

The filing of the GSTR 1 tax form will be done online on GST Portal by the registered taxpayer or his/her representative. The process for filing GST Return 1 Form is quite simple. You just need to login to your account on the portal and then browse and open the relevant form (GSTR1 in this case). Some of the details will be auto-populated based on your registration and tax information. You can fill the remaining details as you go.

Read complete GSTR 1 filing process here

Utility for filing GSTR-1 on GST Portal

GSTR 1 offline utility tool is the official application for filing offline GST returns. Those, who wish to file their GSTR 1 and other returns in the offline mode, can download the tools from the link below.

Download Complete GSTR 1 Utility

Looking for GST Software To File GSTR 1

The GST Software is a computer application that lets you file GST returns online or offline from your computer or mobile without having to visit the official GST portal.

The software is mainly beneficial when you need to file multiple returns quickly and easily. It is also suitable for those who wish to avoid the long line of GST filers on the common portal.

Thanks sir,

For providing this valuable information.