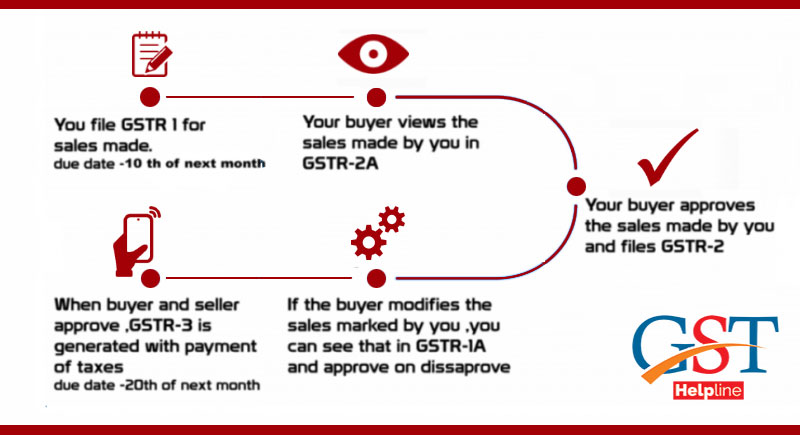

In our previous article, we discussed how to file GSTR-1 for outward supplies of goods and services. In this article, we will learn how to file GSTR-2 Form for inward supplies.

What is GSTR-2?

GSTR-2 is one of the GST tax return forms. This form is used to file the details of inward supplies (imports) of taxable goods and services. Every taxpayer recipient of goods/services is required to submit details of all his/her inward supplies by 15th of the next month for a particular tax period online on GST portal.

GSTR-2 is one of the GST tax return forms. This form is used to file the details of inward supplies (imports) of taxable goods and services. Every taxpayer recipient of goods/services is required to submit details of all his/her inward supplies by 15th of the next month for a particular tax period online on GST portal.

Most of the information in GSTR-2 will autofill based on the details provided by the supplier party in their GST return. The recipient taxpayer has the options to modify, accept, or reject the auto populated information or keep the transaction pending (for pending supplies).

Due Date for GSTR-2

| GSTR 2 Due Dates | |

| For Month Of | GST Return Filing Due Dates |

| July 2017 to March 2018 | Postponed until 31st March 2018* |

Note: In normal cases, regular due dates for GSTR-2 is 15th of the next month for a particular tax period. However, the filing of GSTR-2 has been postponed until 31st March 2018 by GST council.

Note: For subsequent months, i.e. October 2017 onwards, the amount of late fee payable by a taxpayer whose tax liability for that month was ‘NIL’will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts).

Download All GSTR Form Formats to File Returns

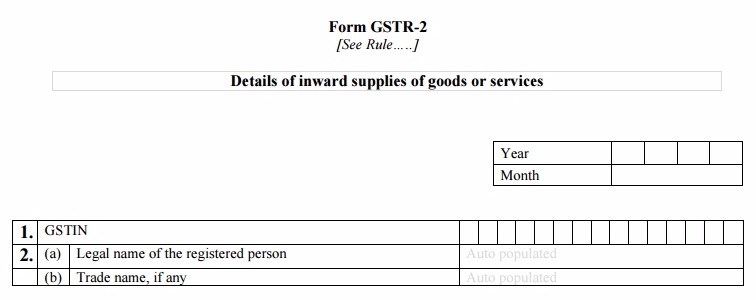

Here’s a table-wise description of various heads in the GSTR-2 return form.

Table 1 & 2: Fill in your valid GSTIN number, the name of the GST registered person and trade name (optional).

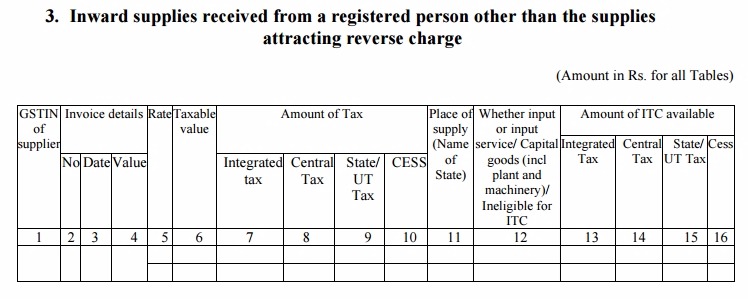

Table 3: This will include the details of all inward supplies received from a registered person other than the supplies attracting a reverse charge. Most of the information will be auto populated here from the GSTR-1 form of the respective supplier. The recipient can manually enter the missing details and/or invoices (not submitted by the supplier), if any.

The recipient taxpayer also needs to mention whether or not he is eligible for credit and if he is, then needs to enter the eligible credit amount.

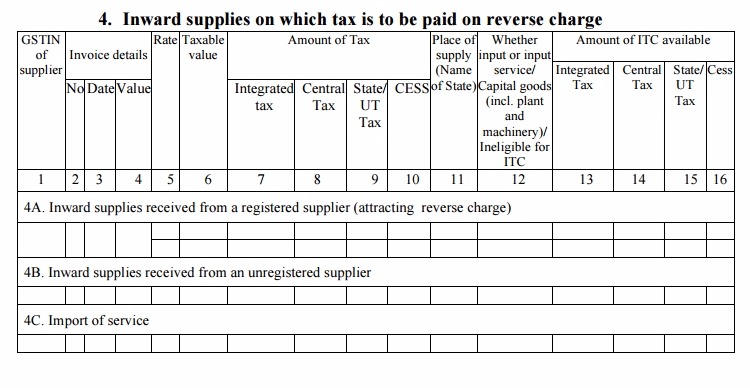

Table 4: The table will include the details of all inward supplies received from a registered person and attracting reverse charge.

Details in the Table 4A will be auto populated.

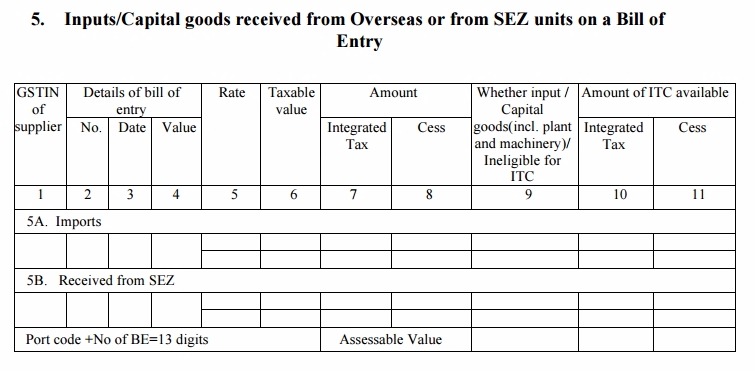

Table 5: This head will include the rate-wise information of all Capital goods received from Overseas or from SEZ units on a Bill of Entry. The recipient has to provide the bill of entry number and port code information here. IGST will be computed on the imports value plus customs duties.

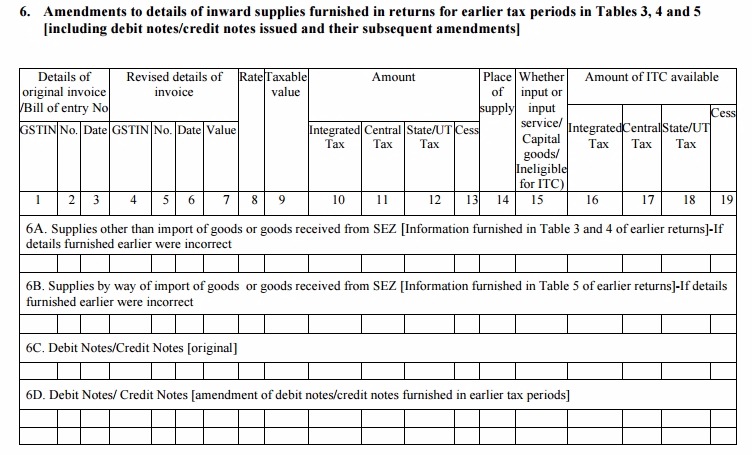

Table 6: This will contain the amendments of rate-wise information provided for earlier tax periods in Tables 3, 4 and 5, including the original information of debit notes/credit notes issued. GSTIN is not applicable for export transactions.

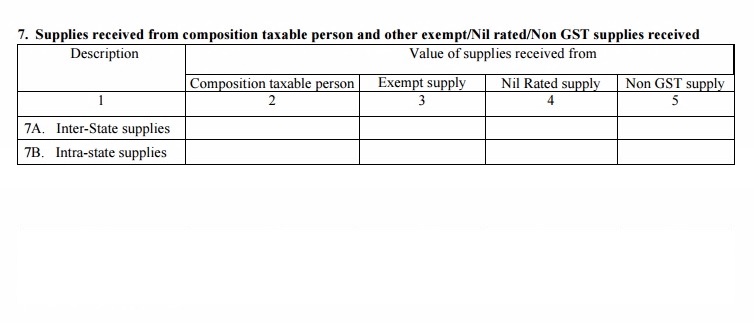

Table 7: It contains the information of the supplies received from composition taxable person and other exempt/Nil rated/Non-GST supplies. It captures information on a whole level.

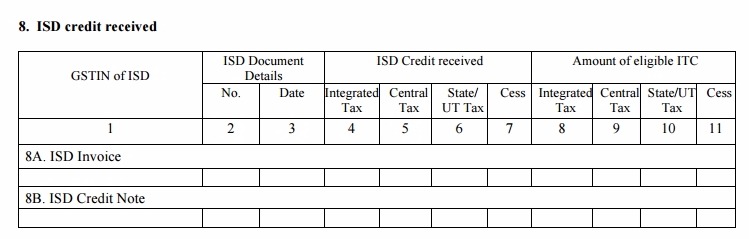

Table 8: Table 8 will be updated with ISD credit received. The credit distributed by ISD will be fully available to the recipient and will be used to determine ITC eligibility and amount.

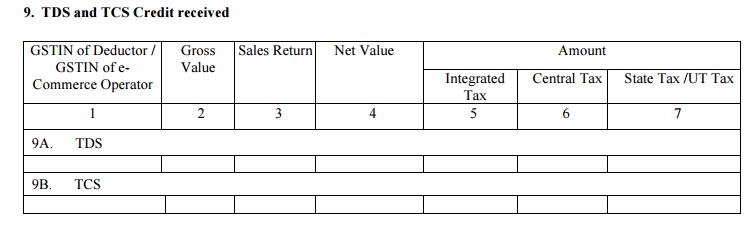

Table 9: Table 9 will contain the information of the TDS and TCS Credit received. It will be auto-filled based on the available details. Sales return and Net value details are not required in case of tax deducted at source.

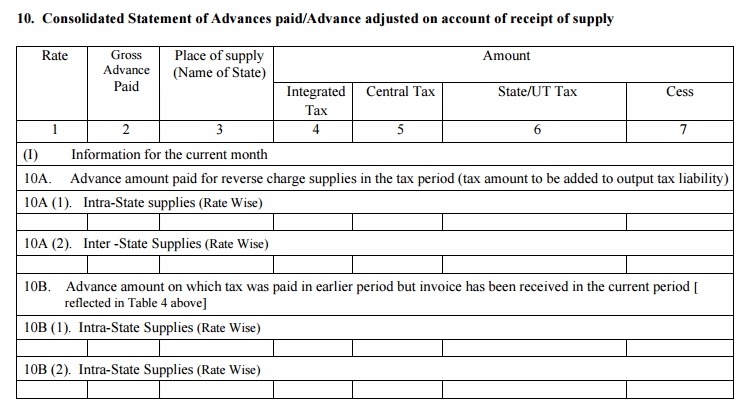

Table 10: Table 10 will include the information/statements of the advances paid or adjusted on account of reverse charge supplies.

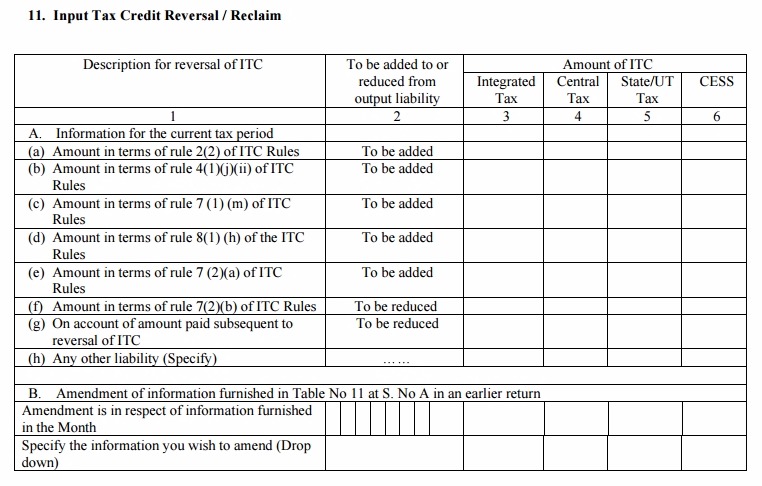

Table 11: Table 11 is to include the details of Input Tax Credit (ITC) reclaims or reversal.

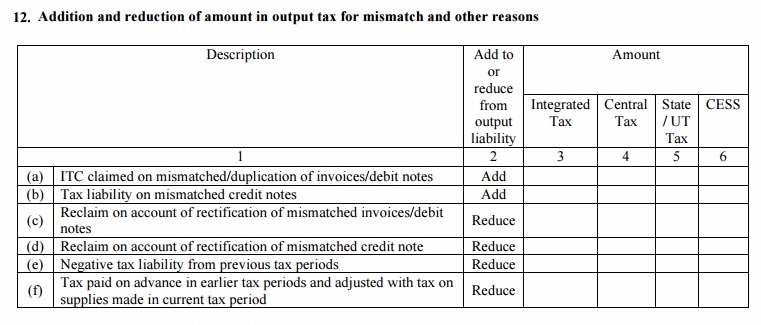

Table 12: It will contain additional liability details (addition and reduction) in output tax due to mismatch or to rectification of mismatch while filing GSTR-3 of the last tax period.

Table 13: This will include HSN codes for all inward supplies.

Notes:

The eligible credits for inward supplies (from Table 3, 4 & 8) will auto populate in the Electronic Credit Ledger of the recipient after the submission of its return in GSTR-3 Form.

A recipient can claim less ITC based on the use (business purpose or non-business purpose) of an invoice.

Important Terms used in GSTR-2

GSTIN: Goods and Services Tax Identification Number

UIN: Unique Identity Number

UQC: Unit Quantity Code

HSN: Harmonized System of Nomenclature

POS: Place of Supply (Respective State)

B to B: From one registered person to another registered person

B to C: From registered person to unregistered person

Feel free to ask your GSTR-2 related queries in our free GST Helpline App.

is it compulsory to fill the table of HSN wise summary and the table of No. of documents in GSTR 1 ?

can i file GSTR-2 now after vewing 2A?

Please check here the difference between GSTR-2 and GSTR-2A