If you are looking to Pay GST Tax Online in India, read the complete guide to understand the procedure.

GST (Goods & Services Tax) has been officially implemented on July 1 in India. The new tax system was enabled with the aim to make the overall tax payment process as transparent, accountable and simple as possible. This is why the GST administration has made sure that the complete GST payment process is based on Information Technology. The Indian government has appointed a GST Council which is responsible for setting up rates for different products & services that come under GST, such that both the center and state government get their deserving tax revenues.

The first step in deciding the exact GST rates for various products/services was to come up with the revenue neutral rate (RNR) which is decided on the basis of the total consumption of the product and revenue desired from it. The committee finally set up a fixed RNR at 18%, based on which four different GST rates were decided as 5%, 12%, 18%, and 28% depending on the good/service type.

Contents

GST Payment Due Dates

| Type of Taxpayers | GST Payment Due Dates |

|---|---|

| General | 20th Day of the Next Month |

| Composition | 18th Day of the Next Month of Quarter |

Read Full Article About GST Payment Due Date

GST Taxation Process in India

The GST taxation process gets further complicated because of the existence of three different types of taxes, namely CGST, IGST, and SGST. IGST refers to Integrated Goods & Services tax which is charged on all interstate (between two states) transactions with the aim to devise a common tax system for all interstate and import/export purchases and sales. CGST is the Central GST which is charged by the Central Government on all intra-state (same state) transactions, while SGST (State GST) is charged by the state governments on the same intrastate transaction. See the table below.

| Transaction type | IGST | CGST | SGST |

| Sale/purchase from one state to another | Yes | No | No |

| Sale/purchase within one state | No | Yes | Yes |

| Sale/purchase within one city | No | Yes | Yes |

GST Payment Process and Rules

Before GST, there were three major types of taxes in India. VAT for all intrastate sales of goods & services. The rate depended on the particular state. CST was applicable for all interstate movements of goods and there was no input tax credit option for this tax. Excise duty applied on the capital goods.

Now, there is one GST tax system throughout the country. The GST payment due date is at the time of supply.

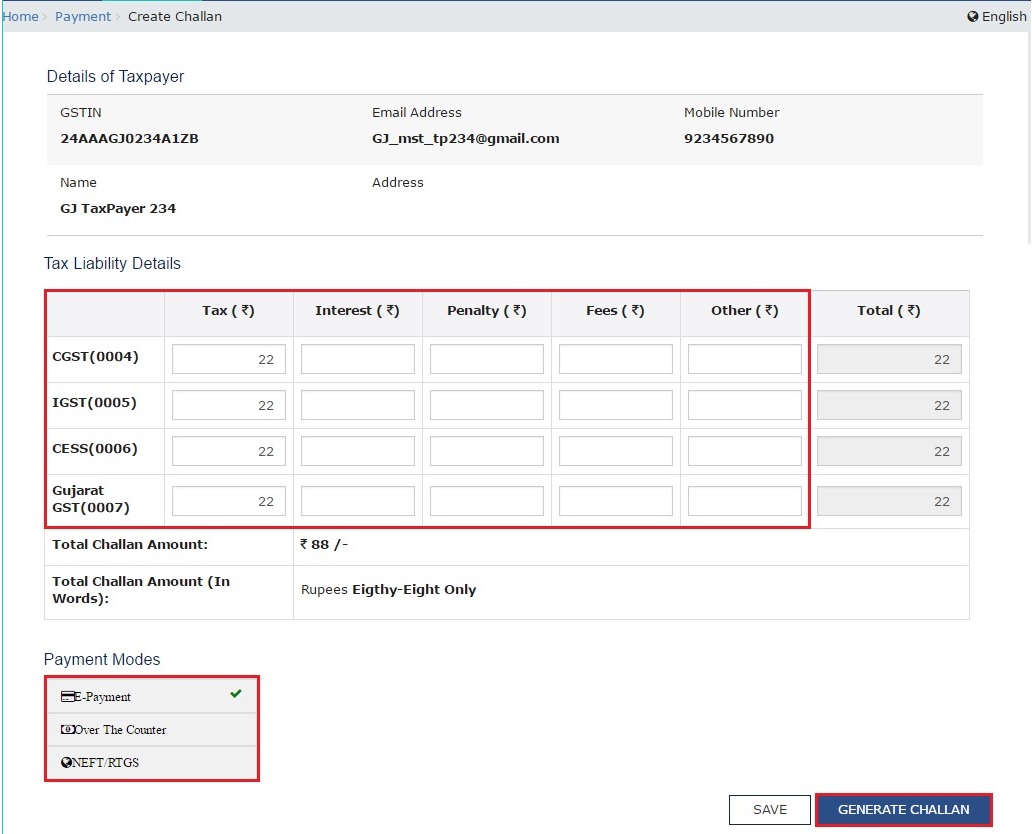

The following three payment modes have been finalized for GST tax processing.

- Payment through Internet Banking of the authorized banks, or through credit/debit cards

- Payment through NEFT/RTGS of any bank.

- Over the Counter (OTC) payment in any authorized bank. This mode will allow payments of up to Rs. 10,000/- per Challan.

The challan for each of the above payment modes will be generated electronically through GSTN portal; No manual challans will be used.

Revised GST Payment Rules in PDF Format

Step by Step Guide to Pay GST Tax Online in India

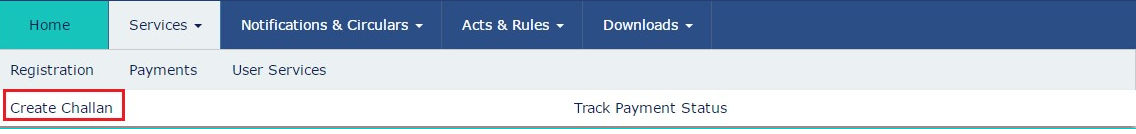

This step by step guide will help you to pay GST tax online easily.

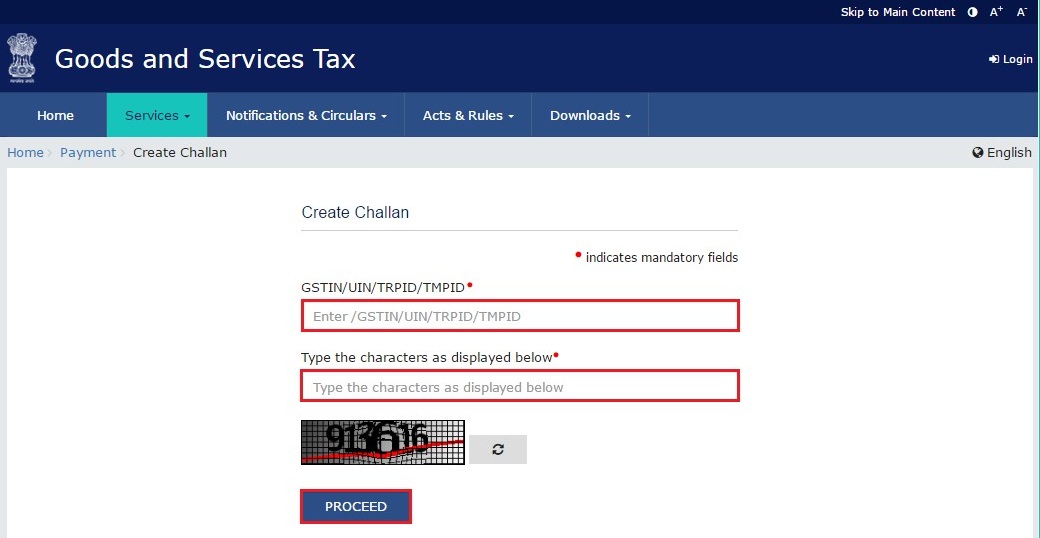

A registered taxpayer or his/her authorized representative will access the GSTN portal to generate the payment challan.

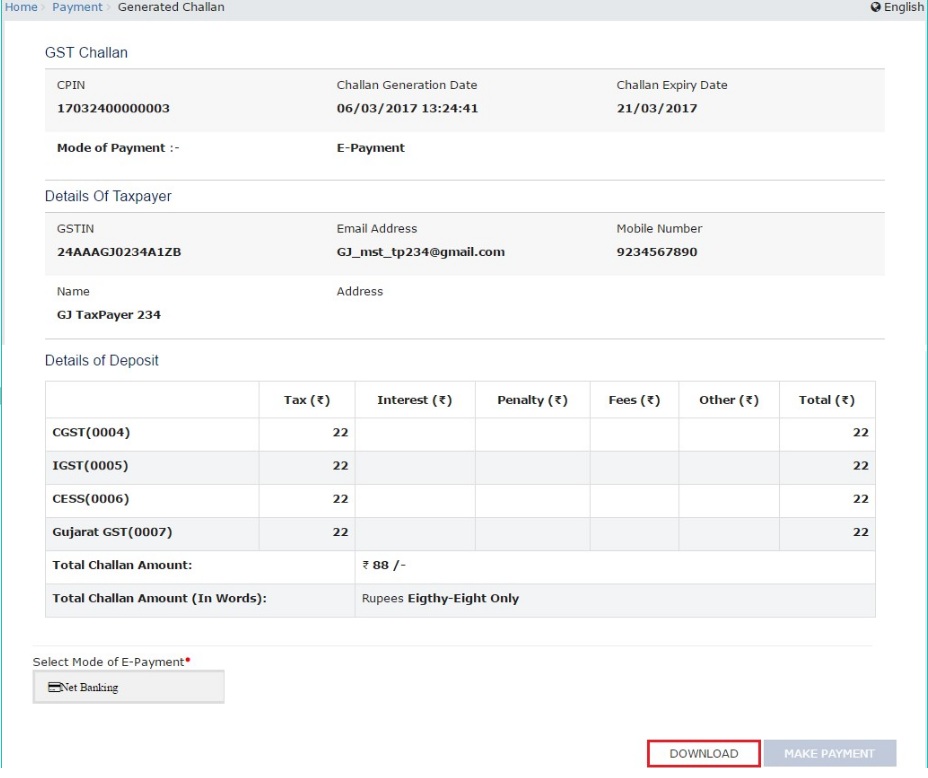

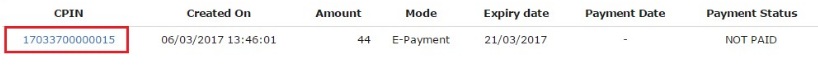

After creating the draft challan, the taxpayer will fill in the tax details, amount, etc. and save the challan form. After the finalization of challan, the taxpayer will generate the challan for the payment of taxes. The challan will have a unique 14-digit Common Portal Identification Number (CPIN).

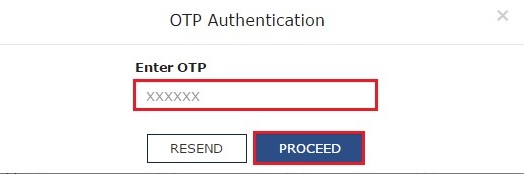

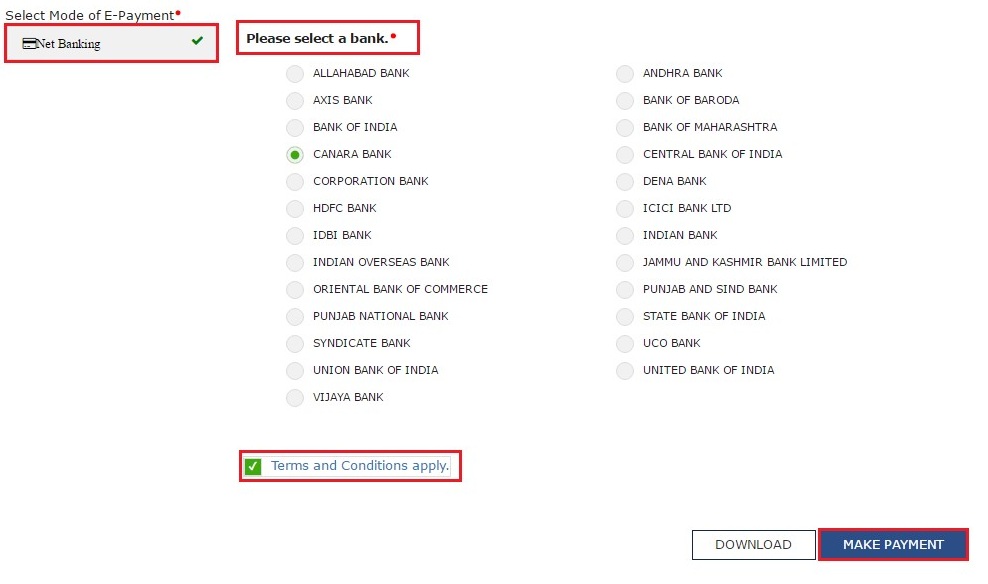

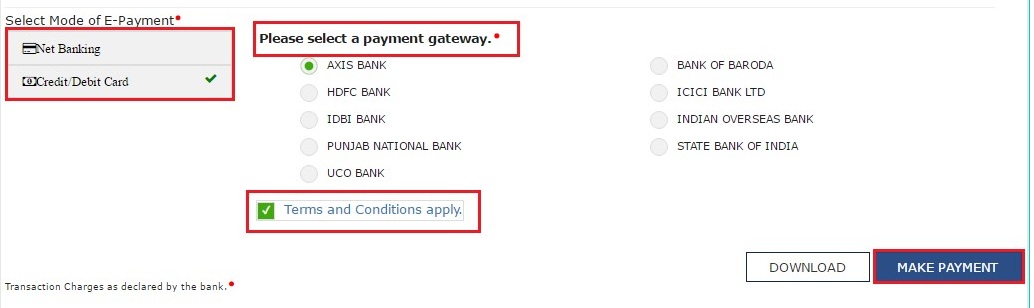

In the next step, the taxpayer will have to choose an e-payment method out of the available ones.

Then, he/she can proceed with the payment by entering their credit/debit card details or using the net banking system of their respective banks.

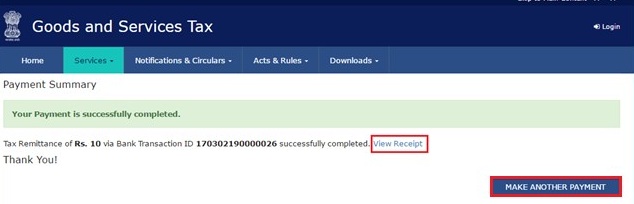

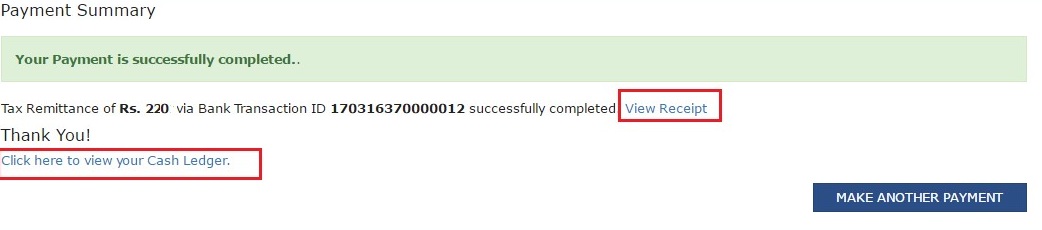

After a successful transaction, the bank will create a unique 17-digit Challan Identification Number (CIN), which can be saved by taxpayers as a proof of successful tax payment.

After payment confirmation, GSTN will inform the respective tax authorities about the tax payment. It will also provide a copy of the payment challan containing CIN, payment date & time, and a confirmation statement to the user.

The tax paid challan will be credited to the tax ledger of the respective person.

Each taxpayer will have to maintain an electronic cash ledger in GST where all the due tax amounts, interest, fee, penalty and other related deposits can be made only through electronic modes such as NEFT, credit/debit cards, etc. on or before the GST due date. The Electronic Input Tax credit ledger will be used to manage the records of the available input tax credits for a particular person. There is a third type of online record namely Tax liability ledger which will hold the records of any outstanding liability for the regular tax returns, penalties, etc. Credit available under tax credit ledger can be used for the fulfillment of any liability. If the input tax credit is not claimed within one year from the date of tax invoice, it will expire automatically.

Features of GST payment processing system

The GST payment procedure has the following features:

- Only electronically generated challan from GSTN Common Portal will be eligible for all modes of payment.

- Anytime, anywhere mode of tax payment.

- Online payment facility

- Electronic format based logical tax collection data

- Paperless tax transactions

- Online receipts

- Digital challan warehousing

- Faster tax remittance to the Government accounts

- Fast accounting and reporting

- Easy maintenance of input tax credits

GST Refund & Return Processing

In the old tax system, the returns for VAT/CST taxes were calculated annually with often delays in the processing. The GST system has resolved this issue by implementing an electronic system for tax refund application, calculation, and processing. Due to electronic data upload and processing, the refunds would be calculated automatically. Taxpayers can claim their GST refunds by filling an application on the GTSN common portal.

The GST return processing time has been fixed as sixty days from the date of receipt of application but the process usually takes two to three weeks. As per the GST Model Law, if the tax return is not refunded within sixty days from the application date, interest at a specified rate shall be paid to the taxpayer for the additional days until the tax is refunded.