It’s time to GST enrollment. GST is a complete overhaul of the old indirect tax system, and what makes it even more disruptive is the fact that all transactions under GST – right from GST registration and raising invoices to file returns and paying taxes – have to be done online.

There would be no manual filing of returns, no paper invoices and no physical payment of taxes. It also means all existing assessees and those who are likely to come under the tax net, have to adopt a digital interface to interact with the tax authorities and move their internal operations to the digital space.

Contents

Time Period For GST Enrollment

The GST Enrollment process first and leaving everything else for later. The Government of India had started the third phase of GST registration from 25th June that carried on until 30th June. This time, unregistered and new applicants can also apply.

Who Need To Get Enrollment For GST

Every trader who has the annual turnover of more than 40 lakhs and all those who until now have been paying VAT, Excise or Service Tax; need to get themselves registered for GST. All the VAT, Excise or Service Taxpayers will get 30 days time to get themselves registered after the implementation of the GST.

Note: Exemption limit has been increased from Rs 20 lakhs to Rs 40 lakhs for GST registration.

Cost Of Enrollment | GST Registration Fees

Do remember that the whole GST registration process is free, however, the help from any CA or IT solution firm for the registration may cost up to Rs. 3000.

What Is GSTIN?

Once you have got the enrollment number, the process of registration is almost complete. One might be asked for the upload some sales related documents from the department. after which the provisional GST registration number is generated, which will get converted into the GSTIN number after the implementation of the GST.

Where To Do The Enrollment?

The new GST registration can only be done through the common portal – gst.gov.in. All the previously registered taxpayers must have their GSTN id and password, that was sent via departments he/she is registered with. The new and unregistered will be provided with a special link, and from there they can generate their id and password for the same.

Once, the id and password have been verified, enter your email id and mobile number. Don’t forget to change your id and password with the help of OTP. It must be noted that the unregistered traders can generate their id on the basis of their current documents.

Obtaining the Provisional ID and Password

Taxpayers who have already registered under the Service Tax, State Tax Laws and Excise Tax such as Entry Tax, Luxury Tax, Entertainment Tax and VAT will be migrated to the new GST system. Registered taxpayers will be provided Unique Provisional ID and Password via SMS/ E-Mail. Provisional ID Password compulsory requirements while enrolling for the GST and further can be used to log in for the GST Portal.

GST Enrolment of Existing Taxpayer with Provisional ID and Password

GST Registration Online– Documents Required for New Taxpayers

Apart from provisional ID and password provided, taxpayers must sure that they carry following documents/ information at the time of enrolling for GST are given below:-

A personal e-mail id for receiving confirmation as well as acknowledgment

A proof of identities such as a partnership deed in form of (PDF or JPEG), LLP Agreement and registration certificate. Earlier keep the soft copy of above-mentioned documents so that you can easily upload the documents in the website.

Bank account details which include bank account number along with the image in soft copy, IFSC code, branch address as well as the address of the account holder (front page of the passbook, or bank statement)

A photograph of partners, owners or Karta (in case of HUF) in a JPEG file size not exceeding 100KB.

A proof of appointment of the authorized signatory, in either PDF or JPEG file, not exceeding 1MB.

Registration Process For Enrolling GST

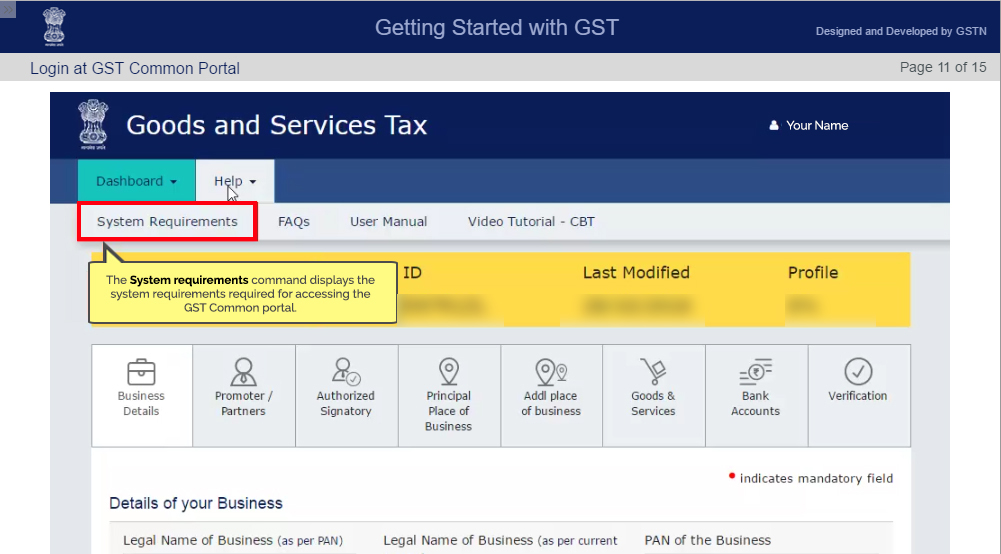

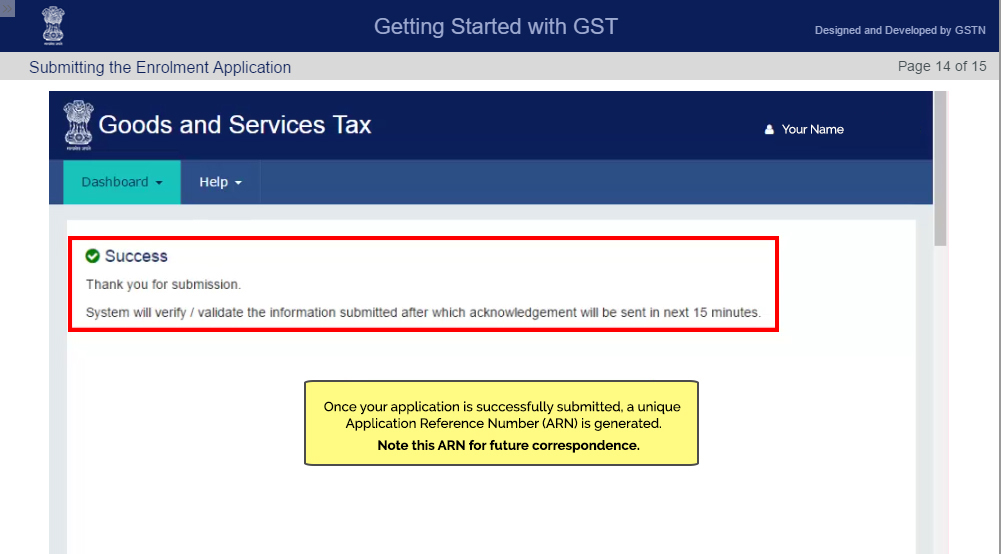

Log in to the GST portal for registration process and enter provisional id and password. Once the id and password are correctly entered, the enrollment application page will be opened. Fill all the details related to your business in the 8 different sections provided there. After the completion of all these 8 sections, a digital signature page is opened, after submission of the digital signature, ARN (Application Reference Number) will be allowed in about 15 Minutes.

For any help regarding the registration process, one can send details at cbecmitra.helpdesk@gst.gov.in or can call on 1800-1200-232.

Online GST registration process step by step:

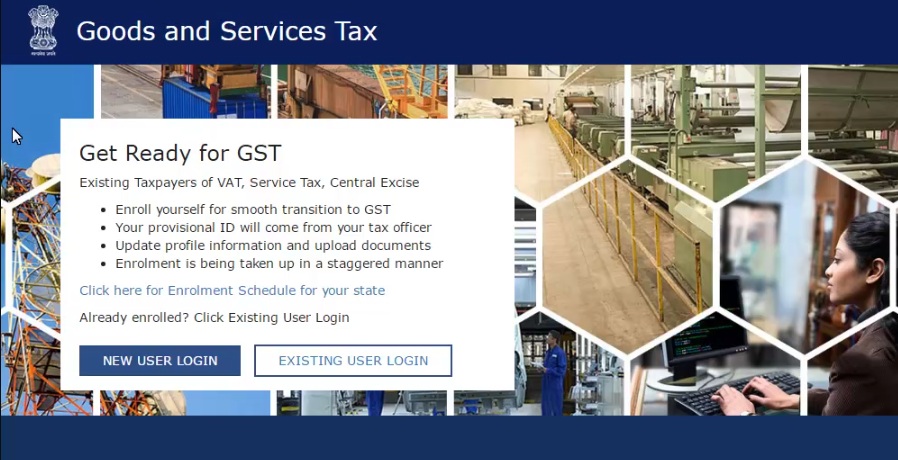

Step 1:- New User GST Enrollment Login on GST Portal

Visit the GST portal and you have two options, click on “new user login” and “existing user login”. As per your requirement click on one option.

Click on ‘I agree’ on the declaration form displayed and hit ‘Continue’ to register.

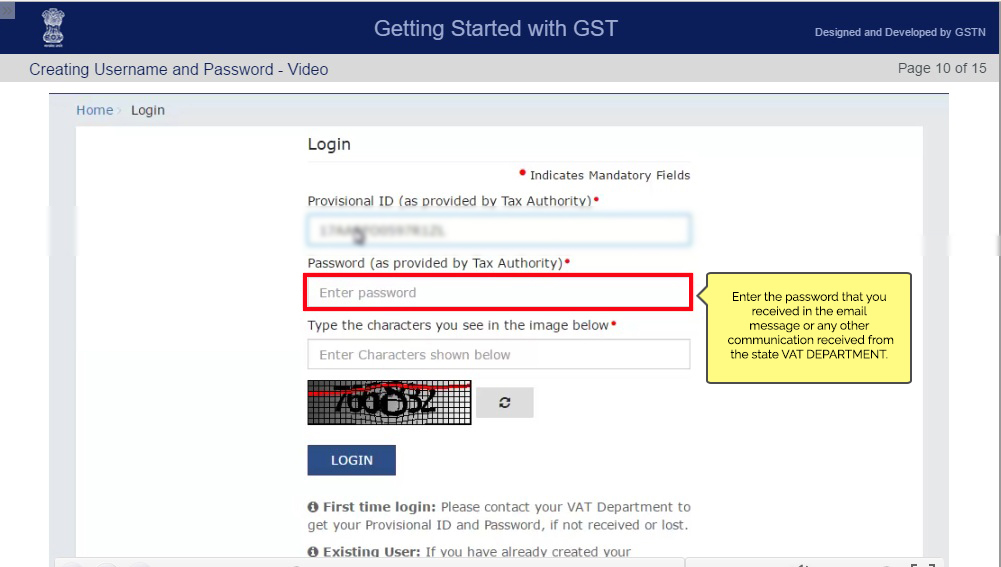

Step 2:- GST Login

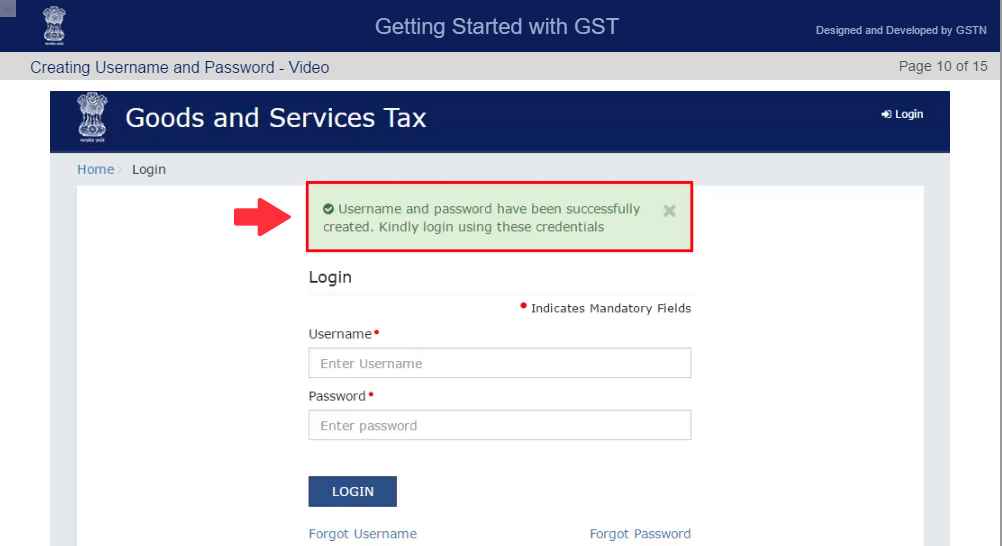

Once you had done with the declaration and hit with ‘continue button’ you are automatically taken to the ‘Login page’. Here, you have to use the ‘Provisional ID and Password’ provided by the tax department via SMS, E-Mail or through any other communication for Log In

If in case ‘ Captcha’ image is not clear, reload it and filled in the required box before clicking ‘Login’ tab.

Step 3:- Credentials Verification

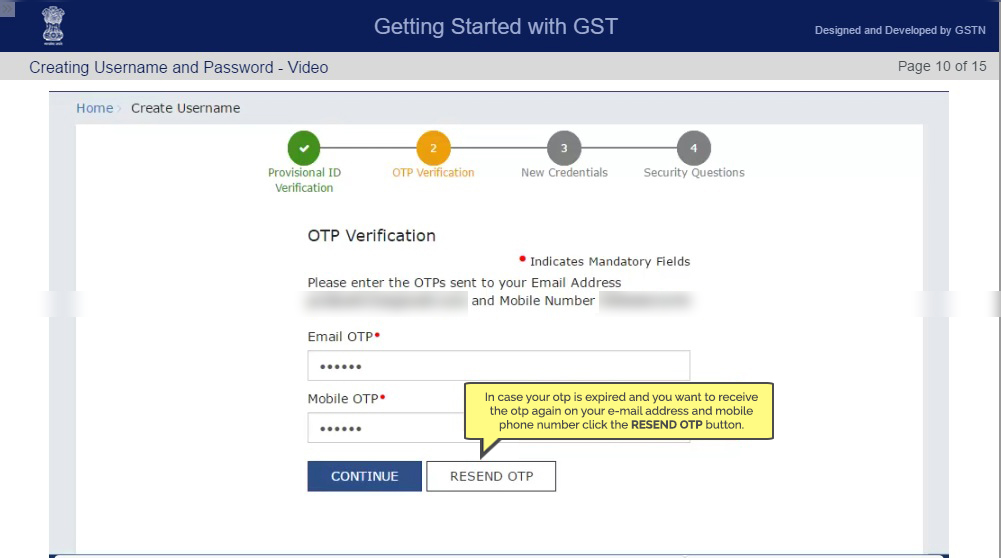

Once you had done with ID provided, you will be taken to a verification page. Here, you must fill all the required details for the enrollment of GST which includes:-

Personal or Valid E-Mail ID

Personal or Valid Mobile Number

OTP (One Time Password) will be sent to the mentioned EMail Id and mobile number, must sure that you have filled the correct details before hitting on ‘continue button’.

OTP will be sent to the both, E-Mail ID and mobile number. Both personal information details will be required for the verification. Make sure that E-Mail Id you have provided will be permanent and will register in the records for any future correspondence.

Any change in both email ID and mobile number can be done as specified by the GST ACT.

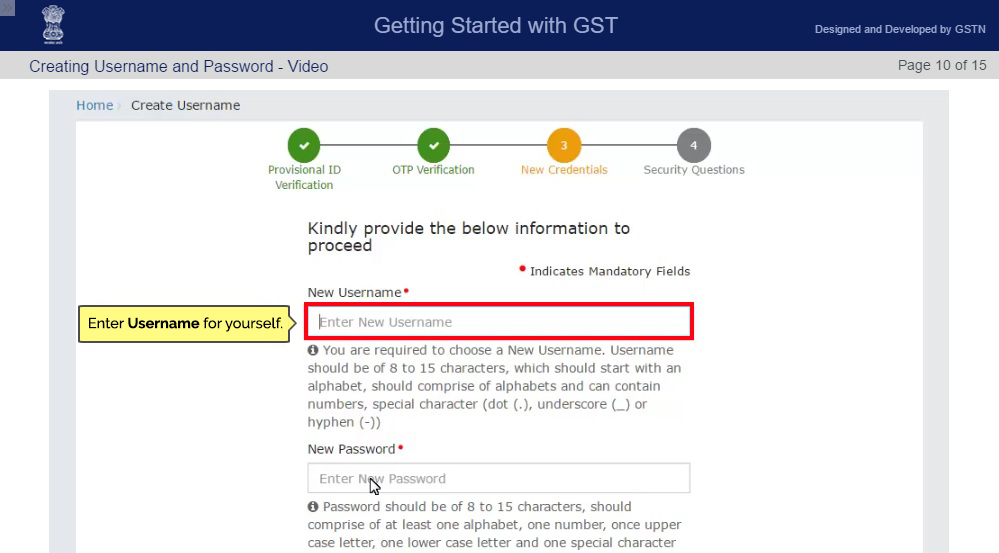

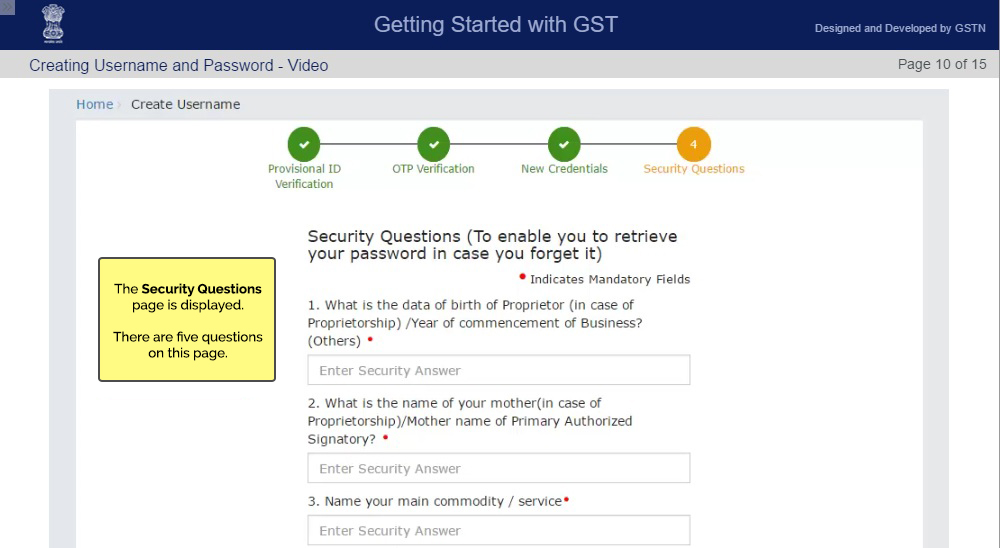

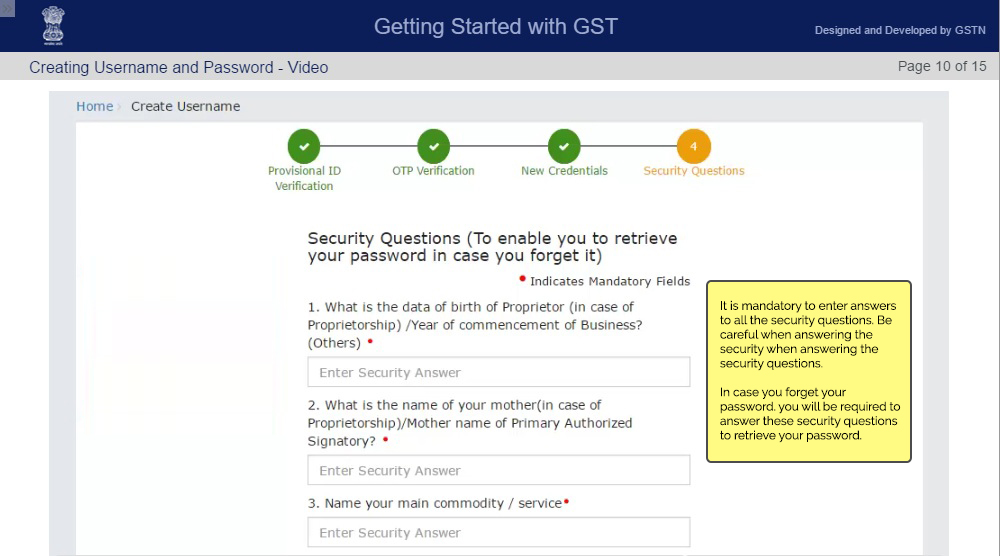

Step 4: Security Questions

Once you had done with OTP verification, you will be taken to page with new credentials. You have an option to fill the personal details for secure login. Change your password to secure login.

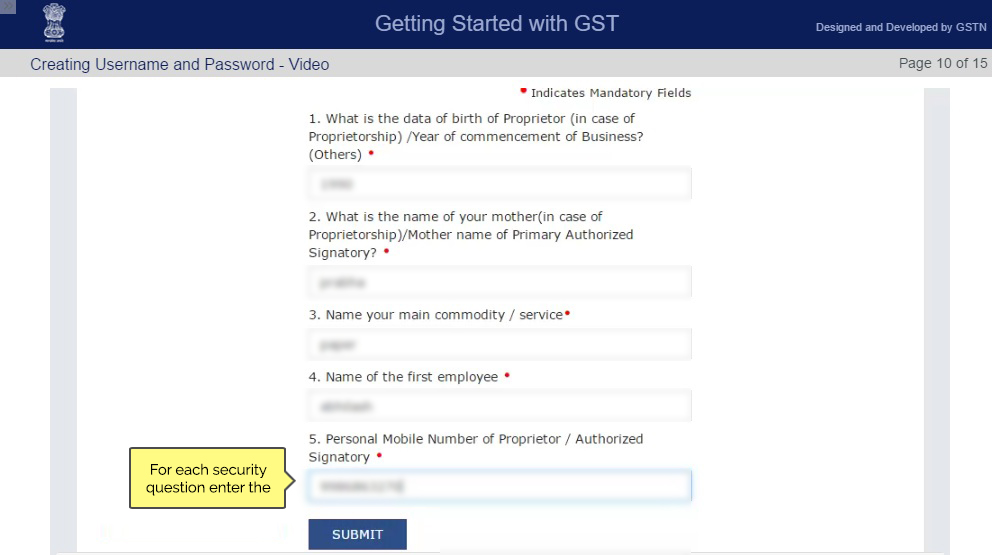

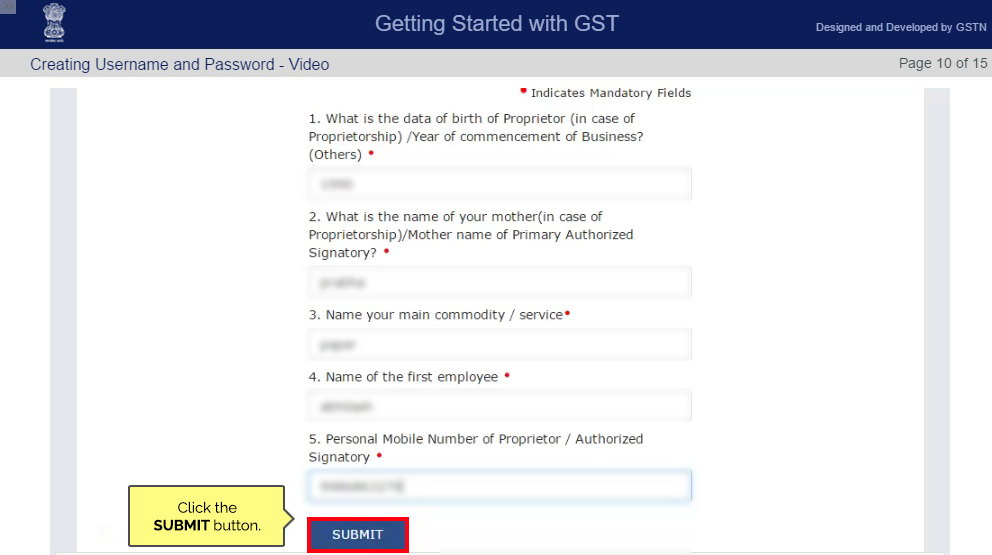

Once you change the password, you will be asked a series of security questions. Answer all security questions and click on ‘Submit’ button.

You will be asked to answer five questions on this page and answer all questions very carefully. It is compulsory to give answers to all the five questions.

Step 5: Enrollment Application

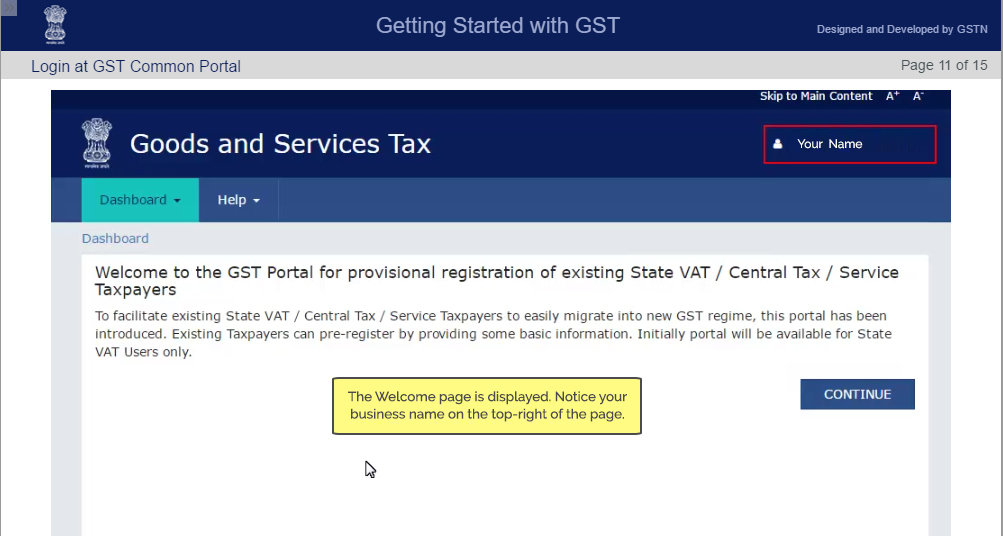

Once you log in an account, after securing the credentials, you will be taken to the ‘Welcome Page’ of your account.

Dashboard Page will consist ‘Provisional ID Enrollment’. Hit on that to get the Enrollment application.

Step 6: Fill the Enrollment Application

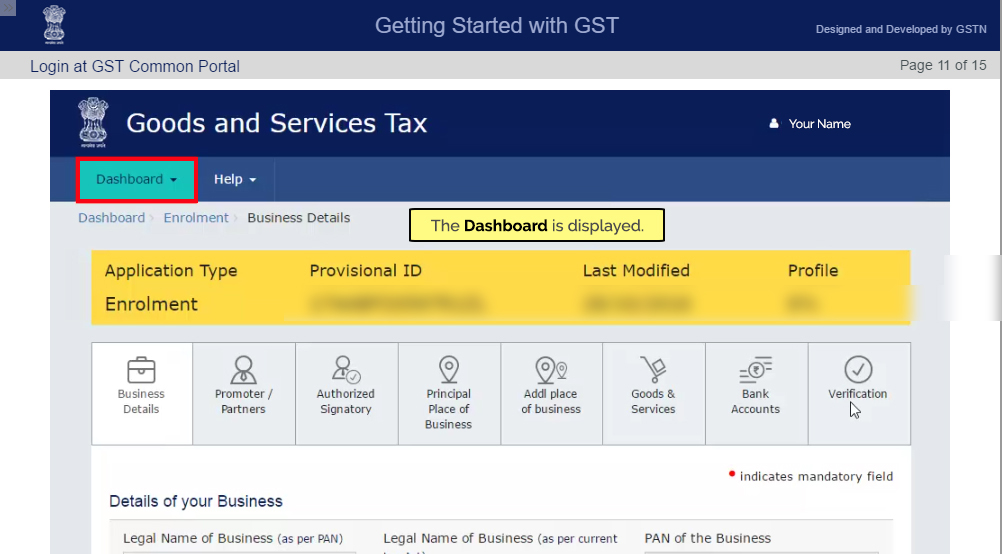

After clicking on ‘Provisional ID Enrollment’ dashboard page will include eight slabs that are mentioned below:-

I. Business details

II. Promoters or partners

III. Authorized signatory

IV. Principal place of business

V. Additional place of business

VI. Goods and services

VII. Bank accounts

VIII. Verification

Fill all the required details in ‘Provisional ID Enrollment’ Application Form very carefully.

Step 7: 8 Tabs

The business details which will be included are as given:-

Apart from the ‘Provisional ID Enrollment’ Application Form to be filled, certain details are auto-populated in the application form through the VAT system. Details includes are as follows:-

a. Legal name of the business as per PAN and Current Tax Act

b. PAN number of businesses

c. State under which the business is registered

d. Ward or circle or sector

The above-mentioned details cannot be changed at any stage. However, some details can be changed or edited are given below

- Trade name

- Constitution of business

- Registration number

- Date of registration of business

- Document upload section.

Once you fill all the details and edit any if required, save the form, and click ‘Continue’.

Step 8:- Owner’s Information

The next page for enrollment of GST will be required the details of the promoters or partners of the business. Enter all the necessary details required, click save and continue.

If in case your business (or the names entered in the partners or promoters section) consists of an authorized signatory, you are required to select ‘Authorised signatory’ tab to fill in the details.

Step 9: Place of Business

Business in which place or state you are operating, enter all the relevant details and click on ‘Continue’ tab. Don’t forget to click on ‘Save’ button and it is a hassle-free process.

Step 10: Goods and Services

Under the category of goods and services tab, you are required to enter ‘HSN’ code of the goods handled under your business. If you don’t know the code simply enter the name of the goods under ‘Search HSN code’ to obtain the same. Hit Save and continue.

The same process will be applied for the services also. SAC code will be required for the services. If you don’t know the code simply enter the name of the services under ‘Search SAC code’ and ‘Continue’ to the next step of the enrollment form.

Step 11: Bank Details

Under the category of bank details, you are required to fill all the bank details which include Bank Account Number, Type of Bank account and IFSC code. Soft copy of Passbook or account statements required to be uploaded at the time of enrollment. Don’t forget to save an enrollment application form after the completion of each step.

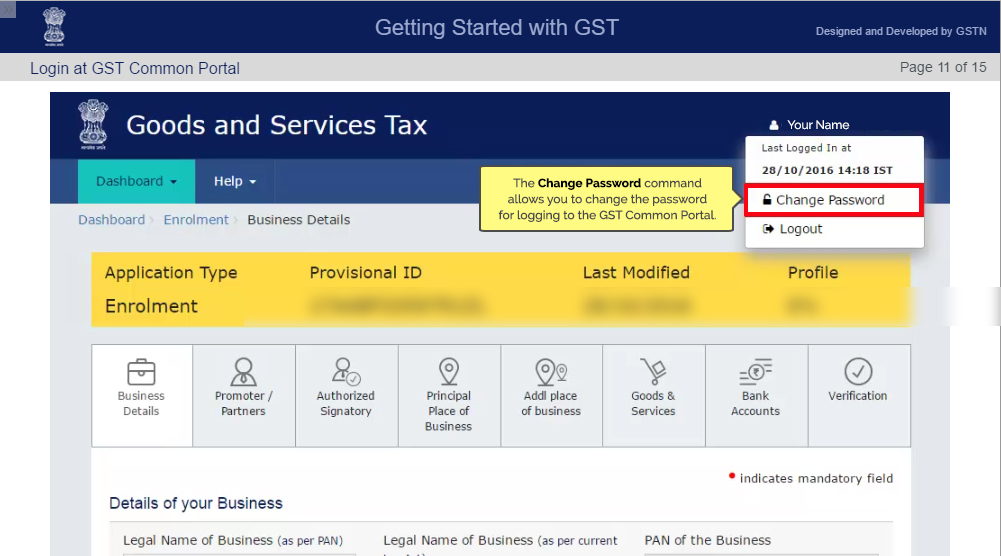

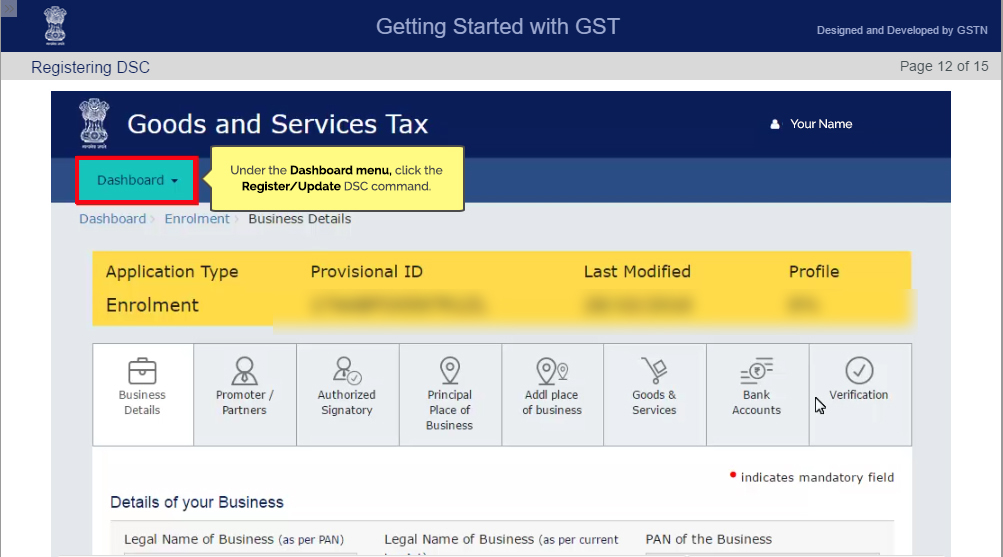

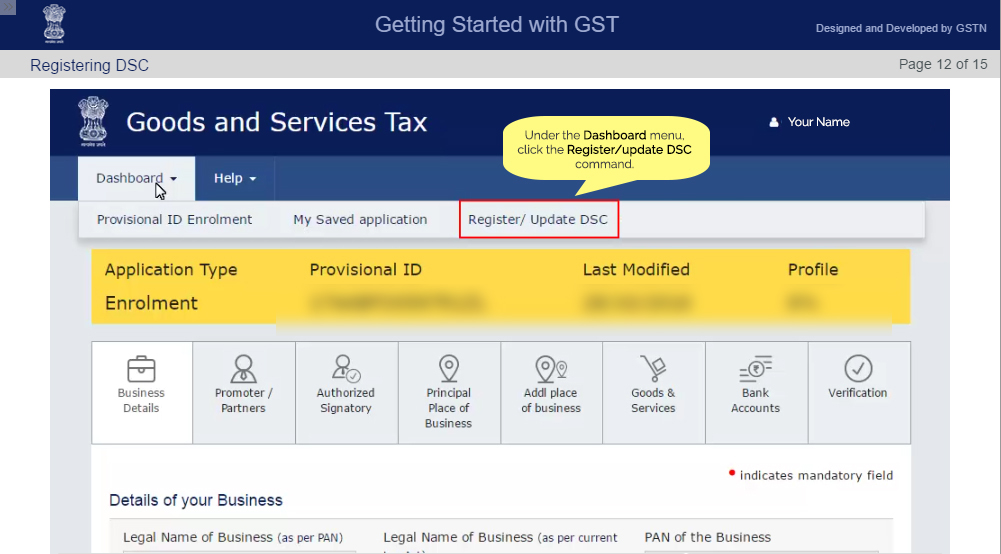

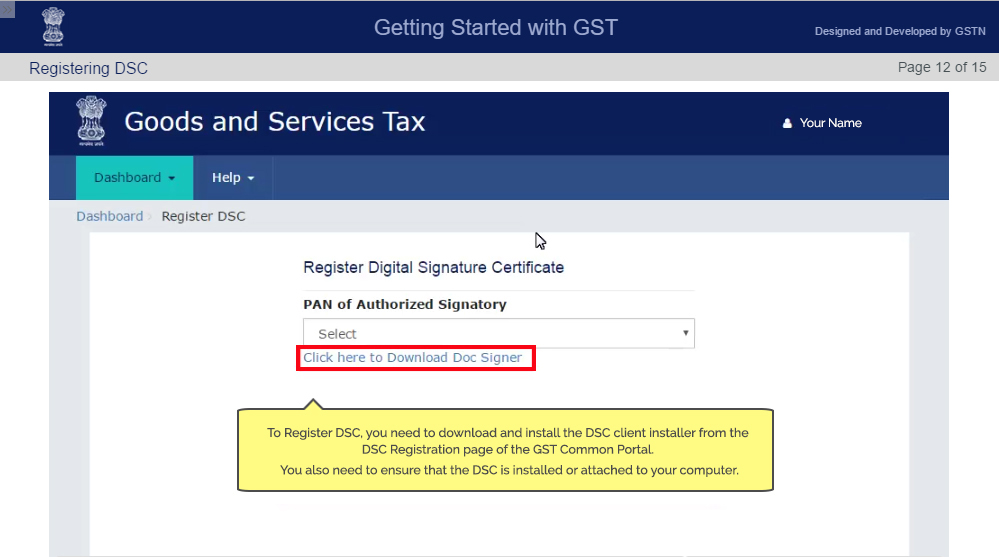

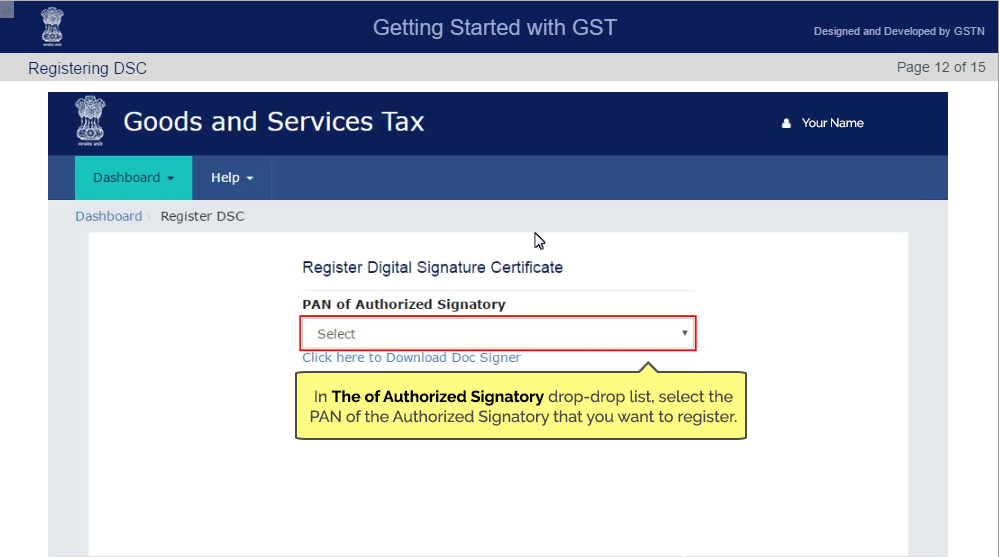

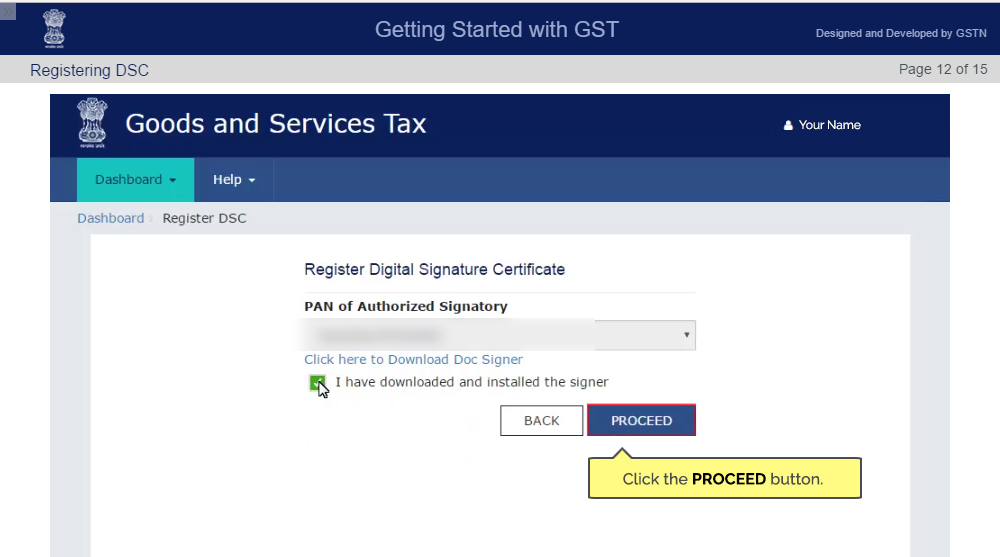

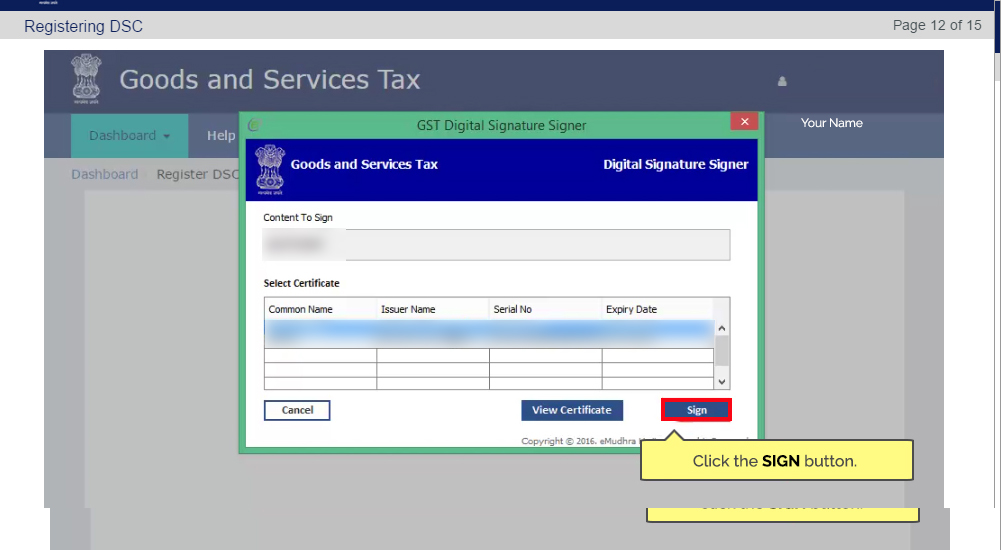

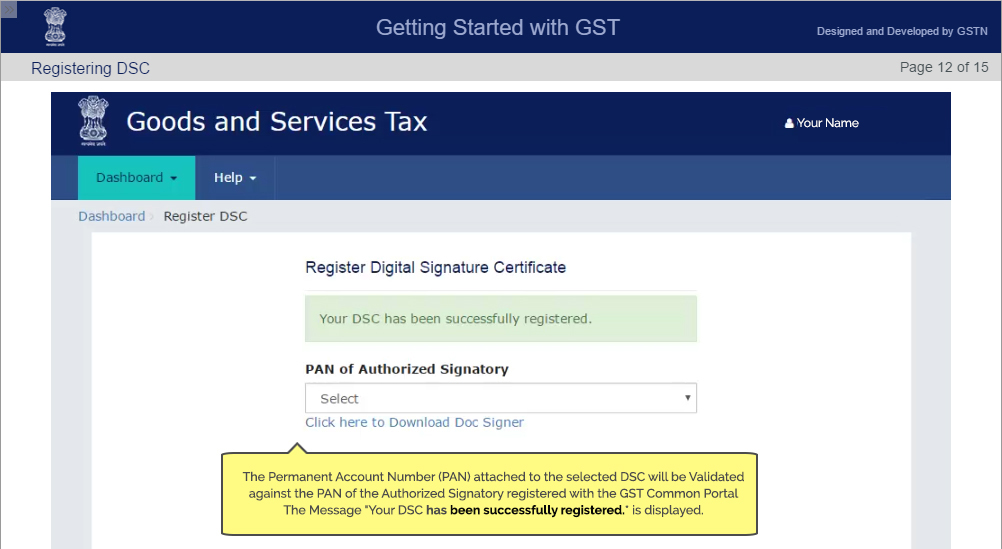

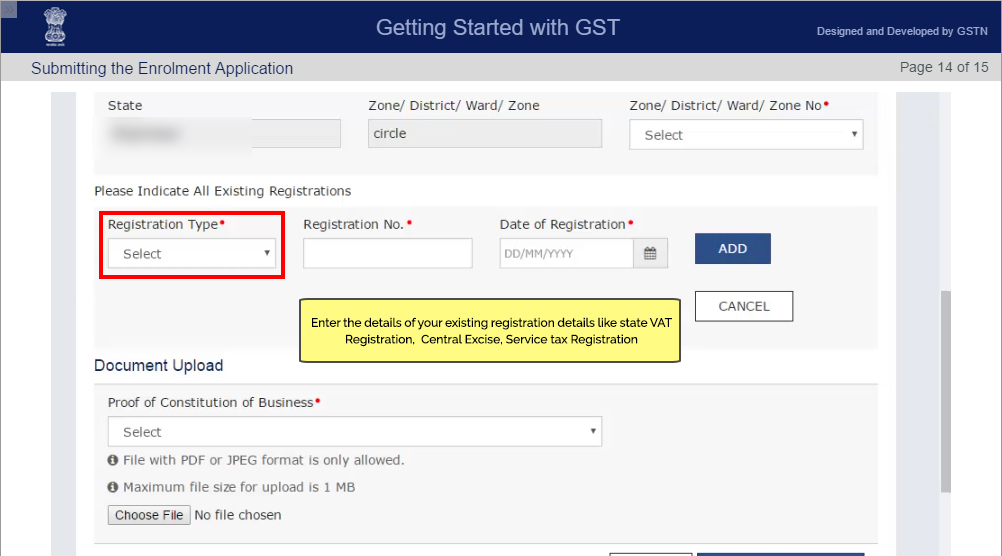

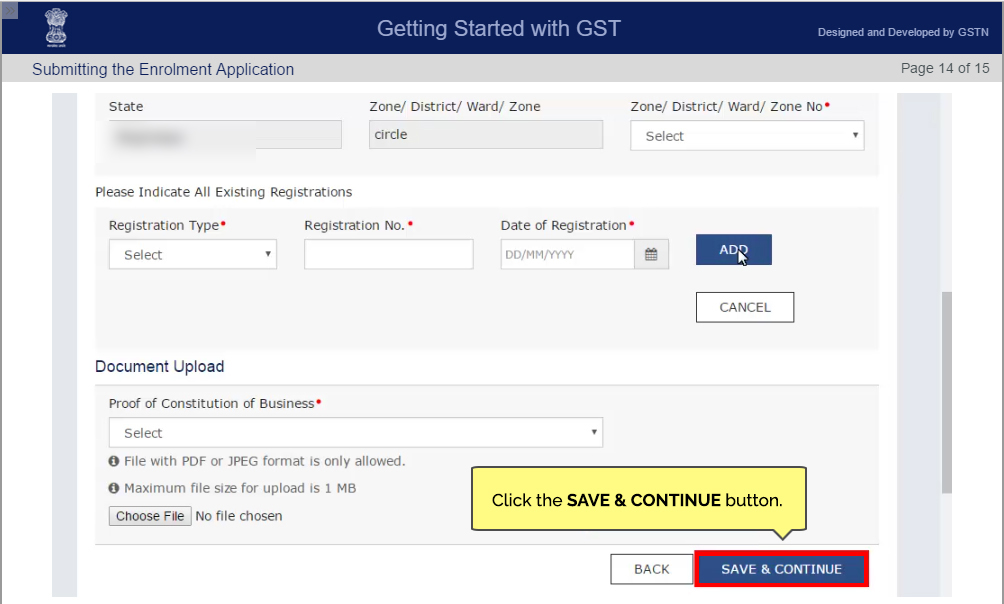

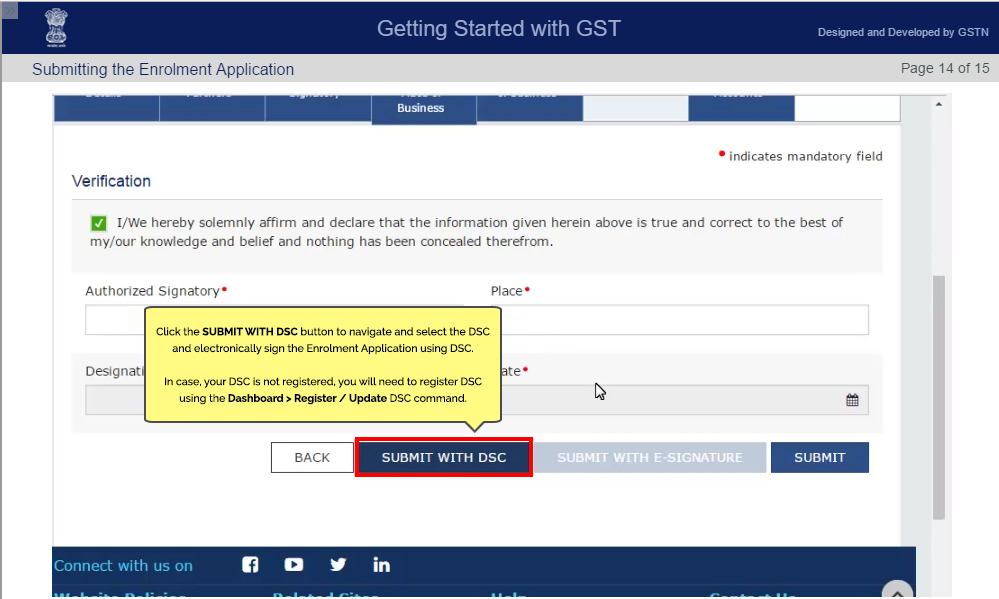

Step 12: Verification

Once you have filled all the details in an application form, you will be asked to verify the details and signature it through DSC (digital signature certificate).

Submit an Application Form with DSC and after verification. The ‘Successful Submission’ message will be shown on the desktop screen. You will receive acknowledgment notification within 15 minutes of submission. Application reference number or ARN will be sent via mail.

If you are existing central excise or service tax assesses, here is the step by step guide for GST enrollment for you.

| Important GST Filing Dates | |

| 20th Dec 2018 | GSTR-3B for Nov 2018 |

| 31st Jan 2019 | GSTR-1 for Oct-Dec, 2018 (Up to Rs 1.5 Crore) |

| 11th Dec 2018 | GSTR-1 for Nov 2018 (More than Rs 1.5 Crore) |

| 18th Jan 2019 | GSTR-4 for Oct-Dec 2018 |

Important Notification: For applicants from J&K, registration will be provisional. The helpdesk is experiencing unprecedented call volumes. Request all to please bear with the rush. Pl try later or use the email helpdesk@gst.gov.in to send your queries.

Conclusion:

GST enrollment will be continuing in order to register more and more dealers, traders and taxpaying entities within the GST framework. Earlier, due to some issues in the name mismatch in government documents and previous tax liabilities of the business units made registrations difficult and by the time of resolution, the enrollment window was closed. Now according to the intensity of the situations, the authorities are opening the enrollment window for a period of 15 days to give another chance for the registration to the business community.

If you have any query regarding GST Enrollment/Registration, please leave a comment here we will try to solve out the query from experts help.

I completed my 100% enrollment form

Still i didn’t get my ARN number…

What does this show

You will receive the ARN at your registered email ID, if the data given are successfully validated after 27th June 2017.

I can’t submit gst application during DSC error. How I submit through 1585 port of emsigner

The issue with DSC signing in GST portal is due to same ports being used by signing application and other application. My observations are that non availability of port is the main reason for Emsigner not working properly.

Dear sir,

During enrollement of GST from TIN VAT registration, our JSON file was wrongly uploaded with another company JSON file by our tax consultancy . Then we raised compaint regarding this and hence wrong company details was erased from our profile.

But we are unable to upload our profile in the GST portal . Now it shows 0% profile .It is not in editable condition. Kindly clear this issue immediately and help us to migrate in GST.

State: Tamilnadu

Circle: Nolambur

Company Name: Hitech Power Solutions

TIN no: 33301351282

PAN : BOGPS8144L

Provisional ID: 33BOGPS8144L1ZG

can I use arn number instead of tin number in invoice

No. You should use GSTN provisional id instead of TIN number. To get the GSTN number, you should contact your CA or sales tax department.

Sir I Have ARN number what is next step

Please read this post to know about ARN Status.

AA0307170672745 status

Dear Sir,

The commercial tax department are given a incorrect provisional I’d of GSTIN…becacuae my firm is partnership by mistake I have use pan card is individual pan card ….

sir ,my GSTIN is inactivated, i want to activate now so what shall i do please inform me

Please read the post about GSTIN