Goods & Service Tax, commonly known as GST, is a new tax system launched to replace the various taxes already in place at the state level and central level in India. GST has been introduced with the aim to devise a one tax system for all good and services throughout the country. In reality, though, there are different types of taxes in the GST system, which is why people are confused about the whole taxation process and the right tax to fill.

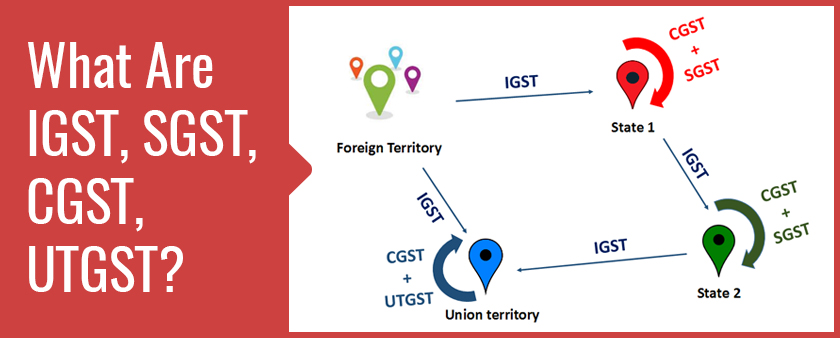

Although GST claims to have a single tax system, there are actually three different taxes namely IGST, SGST, and CGST. The separate state GST is there to protect the constitutional rights of the State Governments to levy taxes on the goods and services sold/purchased within a specific state. In this article, we will discuss the various types of GST in India in detail. Taxpayers are able to take credits against any of the 3 taxes.

Contents

What is IGST and Whom is it for?

IGST full form is Integrated Goods and Service Tax.

Integrated GST (IGST) is applicable on interstate (between two states) transactions of goods and services, as well as on imports. This tax will be collected by the Central government and will further be distributed among the respective states. IGST is charged when a product or service is moved from one state to another. IGST is in place to ensure that a state has to deal only with the Union government and not with every state separately to settle the interstate tax amounts. Let’s try to understand IGST with an example.

Read Also: Filing of TRAN-1 re-opened for Taxpayers till 31st March 2019

E.g, – Ramesh is a manufacturer in Rajasthan who sold goods worth Rs. 10,000 to Suresh in Maharashtra. Since it is an interstate transaction, IGST will be applicable here. Let’s assume the GST rate is 18% for the particular item. So, the IGST amount charged by the Central Government will be Rs. 1800 (18% of Rs. 10,000), and the refined rate of the product will be Rs. 11,800.

Now, GST is a consumption tax, that means only the state where the goods are actually consumed will get the tax benefits, irrespective of the manufacturing state.

What is SGST and Who should fill it?

SGST full form is State Goods and Service Tax.

SGST (State GST) is one of the two taxes levied on every intrastate (within one state) transaction of goods and services. The other one is CGST. SGST is levied by the particular state where the goods are being sold/purchased. It will replace all the existing state taxes including VAT, State Sales Tax, Entertainment Tax, Luxury Tax, Entry Tax, State Cesses and Surcharges on any kind of transaction involving goods and services. The State Government is the sole claimer of the revenue earned under SGST. Let’s understand this with an example.

E.g. – Suresh from Maharashtra wants to sell some goods to Rakesh in Maharashtra. The product, originally priced at Rs. 10,000, will attract GST at 18% rate comprising of 9% CGST rate and 9% SGST rate. The SGST tax amount here is Rs. 900 (9% of Rs. 10,000) which is fully claimed by the Maharashtra State Government. The rate of the product after SGST will be Rs. 10,900.

What is CGST and When is it applicable?

CGST full form is Central Goods and Service Tax.

CGST refers to the Central GST tax that is levied by the Central Government of India on any transaction of goods and services tax takes places within a state. It is one of the two taxes charged on every intrastate (within one state) transaction, the other one being SGST (or UTGST for Union Territories). CGST replaces all the existing Central taxes including Service Tax, Central Excise Duty, CST, Customs Duty, SAD, etc.

Read Also: TDS/TCS Deductions Now Mandatory For E-Commerce Companies From 1st October

The rate of CGST is usually equal to the SGST rate. Both taxes are charged on the base price of the product. See the example below to understand it better.

E.g. – In the example above, when Suresh sales a product to Rakesh in the same state (Maharashtra), he has to pay two taxes. CGST is for the central government while SGST is for the state. The rate of CGST is 9%, same as SGST. After the application of CGST (9% of Rs. 10,000), the final cost of the product will become Rs. 11,800.

As you can probably guess, all the taxes in all the conditions above are borne by the end consumer in the final cost, not by the manufacturer or the dealer of the product or service. Since GST is levied on consumption, the state where the product is originally manufactured does not entitle to any tax amount. If the manufacturing state levies a tax, the same will be transferred to the consuming state through the Central government.

What is UTGST (or UGST)?

UTGST full form is Union Territory Goods and Service Tax.

The Union Territory Goods and Service Tax, commonly referred to as UTGST, is the GST applicable on the goods and services supply that takes place in any of the five Union Territories of India, including Andaman and Nicobar Islands, Dadra and Nagar Haveli, Chandigarh, Lakshadweep and Daman and Diu. This UTGST will be charged in addition to the Central GST (CGST) explained above.

For any transaction of goods/service within a Union Territory: CGST + UTGST

The reason why a separate GST was implemented for the Union Territories is that the common State GST (SGST) cannot be applied in a Union Territory without a legislature. Delhi and Puducherry UTs already have their own legislatures, so SGST is applicable to them.

Read Also: GST Refund Claim Process Make Easier by Govt for Businesses

Difference between different types of GST in India

| Types of Differences | IGST | SGST |

| Applicable transactions (Goods & Services) | Inter-state (between two states or one state and one UT) and imports | Intrastate (Within one state) |

| Collected by | Central Govt. | State Govt. |

| Benefitting Authority | Central Govt. & State Govt. | State Govt. |

| Tax Credit Use Priority | IGST CGST SGST |

SGST IGST |

| Types of Differences | CGST | UGST/UTGST |

| Applicable transactions (Goods & Services) | Intrastate (Within one state) | Within one Union Territory (UT) |

| Collected by | Central Govt. | UT Govt. |

| Benefitting Authority | Central Govt. | UT Govt. |

| Tax Credit Use Priority | CGST IGST |

UGCT IGST |

Similar to every other type of tax, GST also has provisions to give the benefits of tax credits. The credits will be applicable to the subsequent taxes on the same product or service. All three IGST, SGST and CGST credits are usable against each other. Any IGST credit will be first used to deal with IGST tax, then CGST, and then to set off SGST.

You must also by now have understood the need for 3 different taxes; IGST is to ensure a smooth flow of tax credit between states; Dual taxes (CGST & SGCT) are there to ensure that both Center and states get their deserving revenue.

Knowledgeable blog

whether IGST excess(ITC) can be set off agaist SGST payable.

YES…… as per the priority basis i.e, first as to IGST, next to CGST and finally SGST.

In the IGST tax credit priority—– 1st priority is for IGST

2nd CGST

3rd SGST

what about UTGST?????

UTGST is only for Union Territories of India.

Tax is calculated within a Union Territory by: CGST + UTGST

I am a tour operator from Andaman and Nicoabar Islands (UT), people from other states pay me for arranging tours in Andaman Islands. Which GST should I pay? IGST or UTGST + CGST

For any transaction of goods/service within a Union Territory, GST should be paid according to CGST + UTGST.

thank you for this blog.